- What is International business development?

- What Are the Five Key Steps to Structuring International Sales Prospecting?

- Which Channels Should You Use by Region?

- How Do You Test an International Market?

- What Tools Should You Use to Scale Internationally?

- Let’s recap on How to do business development international ?

- Frequently asked questions (FAQ)

Expanding internationally sounds like a dream, right? 🌍

More markets. More opportunities. More growth. 📈

But here’s the reality: going global can turn into a headache fast. Fragmented markets, cultural differences, local regulations… it adds up quickly. If you jump in without a clear game plan, you’ll waste time and money. 🫠

In this article, you’ll discover five practical steps to adapt your strategy for international markets and turn your global ambitions into real, sustainable growth. 😎

What is International business development?

International business development is all about identifying, reaching, and converting customers outside your home market. 🏠

When you say it like that, it sounds simple, right? 😄

But in reality, you can’t just copy your local strategy and swap out the language. You’re stepping into a completely different environment where:

- The way business gets done is different.

- Sales cycles move at different speeds.

- Market maturity levels vary widely.

- Regulations shift from one country to the next.

- A channel that crushes it in one region can completely flop in another.a channel can skyrocket… or collapse depending on the region.

And that’s exactly why this isn’t just execution, it’s strategy.

What’s the Difference Between International Business Development and Local B2B Prospecting?

IWhen you expand internationally, you have to re-learn your market from scratch in every region. 🌍

- A message that works in France might feel too blunt in Germany.

- A LinkedIn strategy that performs in the United States may fall flat in Japan.

- Pricing that feels reasonable in Europe might seem expensive in Southeast Asia.

You’re not just translating words. You’re shifting your entire perspective. 🫠

And this is where most companies get it wrong: they translate their pitch instead of adapting it.

| Dimension | Local Prospecting | International Business Development |

|---|---|---|

| Business Culture | Known norms and implicit codes | Codes must be decoded country by country |

| Regulations | Single, controlled framework | Varying standards (GDPR, CAN-SPAM, local laws) |

| ICP | Relatively homogeneous target profile | ICP evolves based on market maturity |

| Messaging | Stable value proposition | Requires adaptation (angle, objections, benefits) |

| Channels | Predictable performance | Performance varies significantly by region |

| Pricing | Aligned with local purchasing power | Adjusted to perceived value in each market |

| Sales Cycle | Known and relatively stable | Decision timelines and processes differ |

| Management | Global KPIs are sufficient | Global KPIs + country-level scorecards |

Why Is International Business Development a Long-Term Growth Driver?

When you structure your international business development the right way, you: 👇🏻

- 💊 Reduce your dependence on a single market.

- 💸 Smooth out economic ups and downs.

- 🧚🏻♀️ Expand your TAM (Total Addressable Market).

- 👮🏻 Protect your growth over the next few years.

Companies operating across multiple regions are far better positioned to absorb local crises and industry slowdowns. 📈

And here’s another big advantage: some markets may be more mature or simply more receptive to your offer, than your home market. In some cases, you can scale faster abroad than at home. 😉

Going international isn’t just a “nice-to-have.” It’s often a powerful growth accelerator, if you approach it strategically. 🚗

What Are the Biggest Pitfalls in International Business Development?

Let’s be clear: this gets complex fast. Here are the biggest challenges you’ll face:

- 🧩 Market fragmentation: Every country operates like its own ecosystem. Your ICPs can shift dramatically from one region to the next.

- 🗺️ Cultural diversity: Formality, response times, and preferred communication channels vary widely across markets. What works in one country can feel completely off in another.

- 🔢 Compliance & data privacy: GDPR in Europe, CAN-SPAM in the U.S., local regulations in APAC… The rules aren’t consistent. And one mistake can be expensive.

- 💸 Overall ROI vs. ROI by country: One market may generate many leads but few closings, while another produces fewer leads. You need visibility at both the global and country level.

- 💬 Translation ≠ adaptation: Translating your message isn’t enough. You have to tailor your value proposition to local market maturity and pain points.

he right move? Treat your international business development like a system:

Prioritization → Adaptation → Execution → Management → Optimization. 🔁

What Are the Five Key Steps to Structuring International Sales Prospecting?

If you expand internationally without a clear plan, you’ll end up contacting everyone… and closing no one. 😅

To turn international expansion into a real growth engine, you need a structured framework. Here are the five key steps to building international business development that’s effective, measurable, and scalable. 😎

1. Prioritize markets

The first classic mistake? Choosing a country based on gut instinct. 🫠

Because a competitor expanded there.

Because you received two inbound leads from that region.

Or because a partner said, “It’s heating up over there.”

That’s the wrong approach. 😅

You need to prioritize markets using objective criteria. Here are four you should evaluate:

- 1️⃣ TAM (Total Addressable Market): What is the actual volume of companies that match your ICP?

A large country doesn’t automatically mean a large opportunity for you. - 2️⃣ Estimated CAC : What will it realistically cost you to acquire a customer ?

- Data costs.

- Cost of tools.

- Sales time.

- Level of competition.

A high-volume but highly competitive market can quickly drive up your CAC. 🥲

- 3️⃣ Digital maturity of the market

:

- Is your target audience active on LinkedIn?

- Do they respond to emails?

- Are they used to buying online?

For example, many B2B SaaS companies see stronger traction in markets like the U.S. or UK than in less digitally mature regions.

- 4️⃣ Regulatory complexity: GDPR in Europe, CAN-SPAM in the United States, local rules in APAC… Some markets are more restrictive than others. Are you able to adapt?

Score each country from 1 to 10 on these criteria, then calculate a total score.

Your goal? Narrow it down to no more than two priority markets to start with. Why two?

Because launching in four countries at once spreads your resources thin and makes performance much harder to analyze. 🥲

2. Segment your target audience and adapt your value proposition locally

Once you’ve defined your priority markets, it’s tempting to reuse your ICP and pitch exactly as they are. Classic mistake. 😅

Your product may stay the same but how it’s perceived can change dramatically. 😇

Start by revalidating your ICP by country

Your ideal customer in US won’t necessarily match your buyer persona in Ireland or China. Ask yourself these questions:

- Is the target company size the same?

- Is the decision-maker at the same hierarchical level?

- Is the average budget comparable?

- Is the decision-making cycle shorter or longer?

In some European markets, decision-making can be highly centralized (management). In the United States, a Head of Department may have more budgetary autonomy.

Translating is not adapting

Translating your value proposition isn’t enough. You need to adapt:

- Your positioning angle (ROI, time savings, innovation, compliance, etc.).

- The level of formality.

- The customer references you use.

- Anticipated customer objections.

Same product, different story. 🎯

Implement micro-segmentation

Instead of targeting “ SaaS companies in Canada”, go deeper 👇🏻:

- B2B SaaS companies with 50–200 employees.

- Series A or B.

- Sales team larger than 5 people.

- Already active on LinkedIn.

The more precise your segmentation, the more relevant your messaging — and the higher your response rate. 🕺🏻

In international business development, performance doesn’t come from volume. It comes from local relevance. Your goal isn’t to send more messages. It’s to send messages that resonate with the cultural and business context of each market. 🌍

3. Choose the Right Channels for Each Region

Not every channel performs the same way in every market. 🙃 When you expand internationally, channel selection becomes strategic.

Don’t just ask, “Which channel works best for us?”

Instead, ask: “Which channel is culturally accepted and economically viable in this country?”

LinkedIn outbound

➡️ Ideal if:

- Your target audience is professionally active online.

- The social network is embedded in local business practices.

- Your message can be easily contextualized.

LinkedIn enables a less intrusive first touch than cold calling, while still allowing strong personalization. 🎨

Cold email

Cold emailing is scalable and easy to measure. 📊 It allows you to:

- Test a market quickly.

- Measure receptivity (open rate, reply rate, meeting rate).

- Iterate on your value proposition fast.

However, its effectiveness depends heavily on local regulations, the email provider used, the level of market saturation, and the quality of your personalization and lists. 📋

A generic email translated word for word rarely performs well. Adapt the tone, humor, and level of formality. 😇

The telephone (cold calling)

More engaging and more direct, cold calling can be highly effective when ☎️:

- Decision-makers are accessible.

- The sales cycle is short.

- The business culture values direct interaction.

However, it requires more manpower and can feel intrusive depending on the local context. 🥸

Local partners and networks

Often underestimated. In some environments, go through 👇🏻:

- Distributors.

- Local consultants.

- Professional networks (networking).

- Referrals…

can accelerate trust and shorten the sales cycle

This approach isn’t highly scalable at first but it can help you land early deals and build credibility fast.⭐️

4. Build a Multi-Channel Prospecting Strategy

Successful international business development rarely relies on just one channel.

It performs best when you combine channels in a structured sequence. Because thoughtful repetition significantly increases your chances of getting a response. 🕺🏻

➡️ A prospect might:

- Check out your LinkedIn profile without replying.

- Read your email without clicking.

- Finally respond after the third touchpoint.

It’s not spam, if you do it right. 😅

Data shows that combining LinkedIn and email can boost response rates 2–3x compared to using just one channel. The logic is simple:

- LinkedIn builds familiarity.👩👩👦

- Email delivers structure and clear business value. 💎

- Follow-up emails drive action. 🏃🏻♀️

In international markets, where trust takes longer to build, this approach is even more powerful.

5. Set Up Clear Performance Management

Many companies launch international expansion but manage it as one single block. 🚗

The result?

- You can’t tell which country is actually performing.

- You can’t see where to double down.

- And you definitely can’t optimize effectively.

When operating internationally, you need to think on two levels:

- 📊 Global view (consolidated performance).

- 🌍 Country-level view (performance by market).

That’s how you stay in control and turn international growth into a scalable, predictable system.

Which KPIs should you track?

Your management approach should combine quantitative (acquisition) and qualitative (market maturity and friction) metrics. 👀

Here’s what to track:

| Type | KPI | Why It Matters | Warning Sign |

|---|---|---|---|

| Acquisition | Reply rate | Measures message–market fit | < 5% after multiple iterations |

| Acquisition | Meeting rate | Measures sequence effectiveness | High replies but few meetings |

| Acquisition | SQL rate | Indicates targeting quality | SQL < 20% of meetings |

| Acquisition | CAC by country | Measures real profitability | CAC higher than your target LTV |

| Qualitative | Sales cycle length | Indicates maturity & complexity | Cycle 2x longer than main market |

| Qualitative | Key objections | Helps refine positioning | Recurring objection not addressed |

| Qualitative | Average deal size | Shows scalability potential | Deal size too low vs. acquisition cost |

How to build a global vs. regional pipeline dashboard?

If you want to scale internationally, you need to think like a Growth Ops leader. 📊

A good dashboard isn’t just for reporting numbers. It helps you make budget and resource allocation decisions. Your goal? See performance at a glance. 🫣

The global view

This view gives you the consolidated performance of your strategy. It should include 👇🏻:

| Indicator | Why is this important? |

|---|---|

| Leads generated | Measures prospecting intensity |

| Meetings booked | Indicates overall market attractiveness |

| SQLs | Measures pipeline quality |

| Open opportunities | Short- and mid-term visibility |

| Revenue generated | Real business impact |

| Average international CAC | Consolidated profitability |

👉 This view answers one question: Is international expansion profitable overall?

The regional view: your optimization lever

This is where real strategic insight comes in. Each market must be analyzed individually.

➡️ Here is an example:

| Country | Reply rate | Meeting rate | SQL rate | Cycle (days) | Average deal | CAC | Estimated ROI |

|---|---|---|---|---|---|---|---|

| Market A | 14 | 6 | 35 | 40 | $9,000 | $1,100 | 🔥 |

| Market B | 18 | 7 | 20 | 85 | $6,500 | $2,600 | ⚠️ |

| Market C | 7 | 3 | 40% | 55 | $12,000 | $950 | 💎 |

How should this table be interpreted?

🔥 High response rate + good SQL + controlled CAC → Scale this market.

⚠️ High response but low SQL → Fix targeting or qualification.

💎 Low volume but large deal size → Profitable niche worth nurturing.

This type of dashboard helps you avoid a classic mistake: investing heavily in the most active market instead of the most profitable one. 😅

Which Channels Should You Use by Region?

When you expand internationally, the real question becomes:

“Which channel is accepted, effective, and profitable in this market?” 🌍

United States vs. Europe vs. APAC: how do approaches differ?

Cultural norms, digital maturity, and business habits heavily influence response rates. Here’s a practical breakdown of the three major regions. 🗺️

1. The United States

The U.S market is one of the most competitive in the world. Decision-makers are heavily targeted but they’re also very accustomed to outbound . The business culture values speed, clarity, and measurable ROI. 📊

You’re judged on your ability to demonstrate fast, concrete, and quantifiable impact. 😎

The channels that generally perform well are 👇🏻:

- 📋 LinkedIn outbound.

- 💌 Personalized cold email.

- ☎️ Cold calling.

- 🎑 B2B retargeting ads.

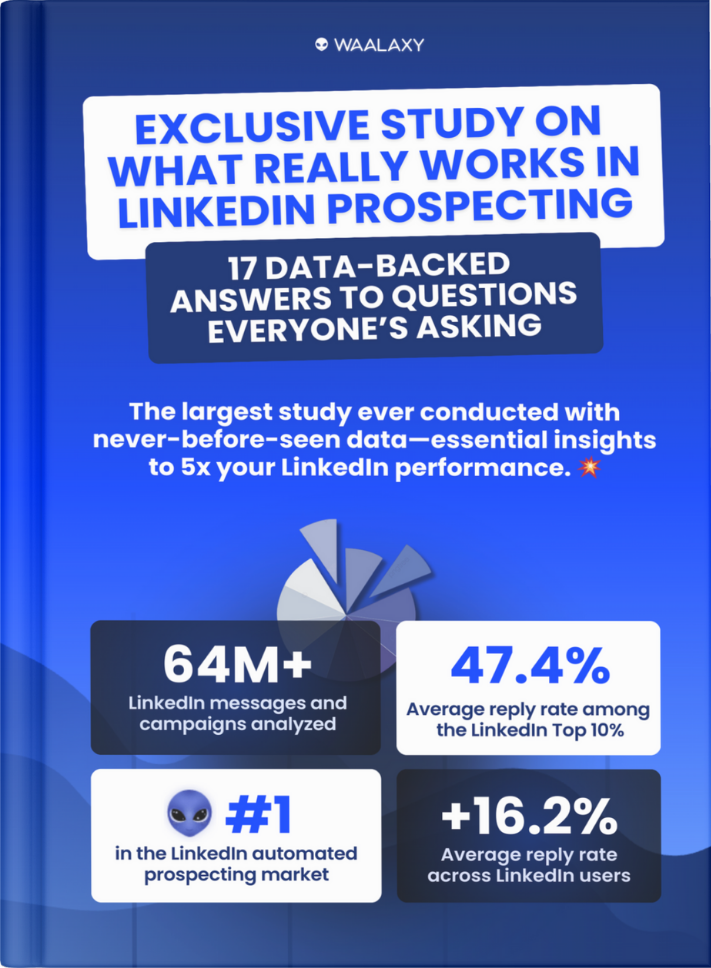

According to the Content Marketing Institute, over 80% of North American B2B marketers consider LinkedIn the most effective social platform for lead generation.

2. Europe

Europe is highly diverse. Cultural differences between countries are significant but a few constants stand out 👇🏻:

- Strong sensitivity to regulatory compliance.

- High expectations around personalization.

- Importance of trust and credibility.

European prospects often expect more context before agreeing to a meeting. You can use these channels 👇🏻:

- 👩🏻💻 LinkedIn (especially strong in the UK, Nordics, France).

- 📨 Highly contextualized cold email.

- 📲 Cold calling in specific markets ( (UK, Netherlands, Sweden, etc.).

Trust and reputation are major drivers in European B2B decision-making.🤓

👉 For example, personalized LinkedIn outreach in Europe often generates response rates around 8–11%, depending on the country and targeting quality.

For cold email, reply rates around 5–10% are generally considered solid when campaigns are well-targeted and properly personalized. 😁

3. APAC (Asia-Pacific)

APAC is equally diverse. Singapore has little in common with Japan, which differs greatly from India or Indonesia. 🇮🇩 One constant across many markets:

Relationships come before transactions.

In several countries, trust must be established before serious business discussions begin. A message that feels too direct or overly aggressive can shut down the conversation. 🥲

You can use these channels 👇🏻:

| Country/Region | Local networks/platforms | Associations & events | Strategic recommendation | |

|---|---|---|---|---|

| 🇸🇬 Singapore | ⭐⭐⭐⭐ Strong | Sector groups | Chambers of commerce, tech & finance events | Digital first + premium networking |

| 🇦🇺 Australia | ⭐⭐⭐⭐ Strong | Local B2B communities | Trade shows, meetups, international chambers | Digital multichannel + calls possible |

| 🇮🇳 India | ⭐⭐⭐ Strong | Tech & SaaS communities | Active startup ecosystem | LinkedIn + highly relevant email |

| 🇯🇵 Japan | ⭐⭐ Moderate | Wantedly or BizReach and professional networks | Professional associations, industry trade shows | Recommended connections and introductions |

| 🇨🇳 China | ⭐ Low | WeChat or Maimai, your network in the country | Events & business networks | Local partner almost essential |

| 🇮🇩 / 🇹🇭 Emerging SEA | ⭐⭐ Variable | Local networks & WhatsApp Business | Industry events | Multichannel testing + cultural adaptation |

How Do You Test an International Market?

Before investing in a new country, you need to answer one key question:

👉 Is there measurable, profitable traction?

Here’s how to structure the test. 👇

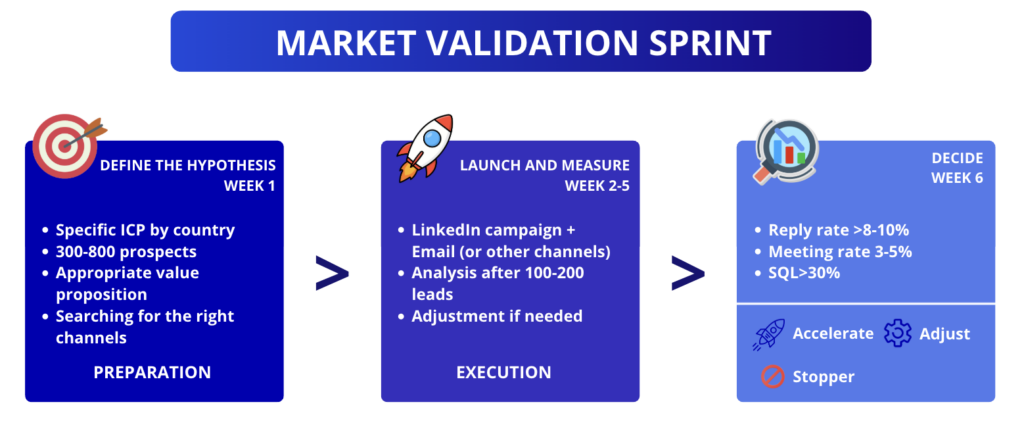

The method“ Market Validation Sprint”s in 30–45 days

You don’t need to open an office or invest tens of thousands of dollars to test a market. 🌍

Instead, launch a structured 30–45 day sprint:

- Define a specific ICP.

- Build a database of qualified prospects.

- Deploy a multi-channel sequence tailored to the country (LinkedIn + email).

- Track reply rate, meeting rate, SQL rate, and CAC.

Then analyze the performance data. 😇

Within a few weeks, you’ll know whether to scale, adjust positioning or targeting or move on to the next market. 😎

That’s the power of structured validation.

What budget do you need to test two markets?

Testing two markets doesn’t require a massive budget. 💸

The goal isn’t to establish a presence, it’s to validate traction within 30–45 days using a disciplined, data-driven approach.

As a benchmark, plan for roughly $3,000–$5,000 (or equivalent) per market for a structured digital test.

The exact cost depends on:

- The tools you use.🛠️

- The quality of your data.🔢

- Localization and language adaptation. 🗣️

- The time allocated to your sales team .⏰

What Tools Should You Use to Scale Internationally?

Scaling internationally isn’t about sending more messages. It’s about sending the right messages to the right targets, with the right management. 📊

Here’s the minimum stack you need to move from testing to scalable growth. 😎

Data & sourcing tools

Before you automate anything, you need precise targeting. To build and enrich a high-quality prospecting database👇🏻:

- LinkedIn (advanced search, Sales Navigator, active participation in relevant groups).

- Dropcontact for GDPR-friendly data enrichment.

- Country-specific platforms, such as MaiMai in China.

Your goal: build clean, segmented lists by country, industry, and company size.✨

In international expansion, data quality becomes even more critical. Poor segmentation sends the wrong market signal.😩

Multi-channel automation tools (LinkedIn + email)

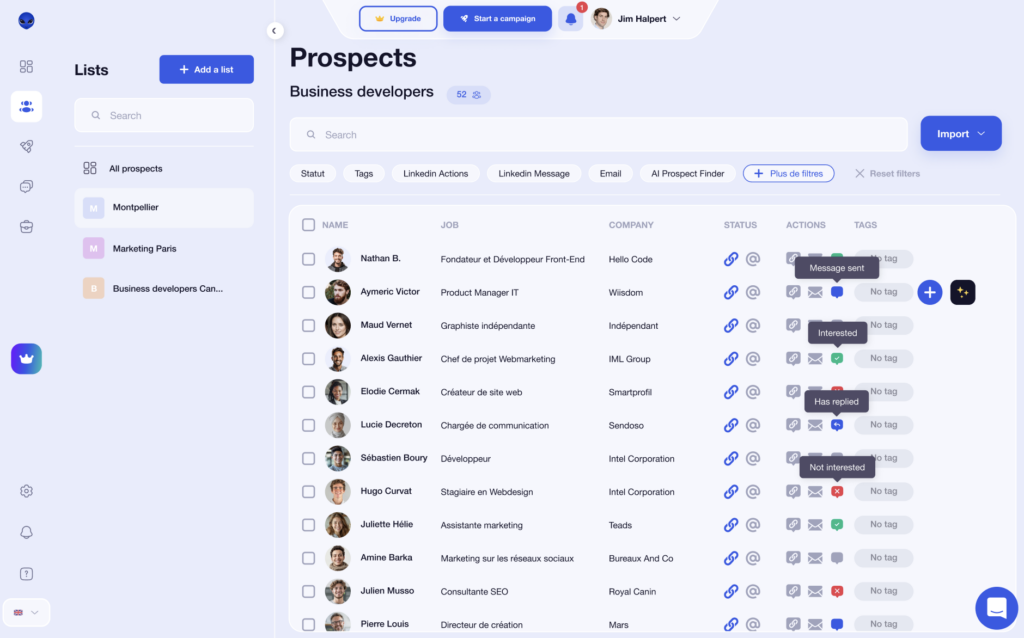

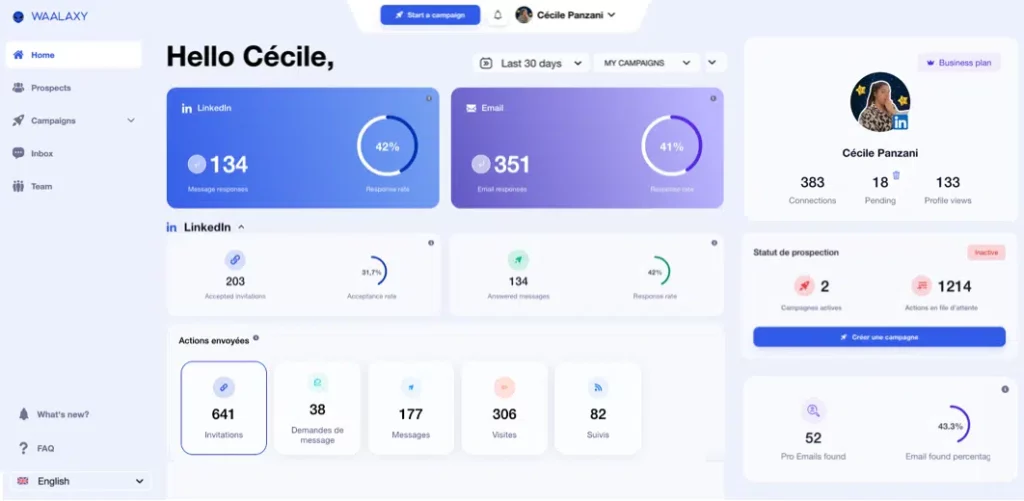

Once your targeting is ready, the challenge isn’t sending messages, it’s orchestrating a clean, measurable, and repeatable system. 🌍 This is where a business software development like Waalaxy becomes essential.

- 🔁 Automate LinkedIn and email within the same sequence.

- 🧩 Build multichannel workflows.

- 🏷 Segment and manage lists with smart tagging.

- 📥 Centralize conversations in one inbox.

- 👥 Collaborate easily with your Team plan.

- 🌍 Test multiple markets simultaneously.

- 📊 Track KPIs by campaign.

This setup is especially powerful for:

- 🚀 Launching a Market Validation Sprint quickly.

- 🔄 Replicating a successful sequence across multiple countries.

- 📈 Objectively comparing performance between regions.

Let’s recap on How to do business development international ?

International business development whether you call it global business, new business, export strategy, or comprehensive international expansion, sounds like a dream. 🌍

But without a clear method, it can quickly become expensive. You can’t simply translate your strategy you have to adapt it.

Markets, ICP, messaging, channels, performance management… everything must be designed country by country. With a structured approach, smart prioritization, multichannel outreach, clear KPIs, and a Market Validation Sprint...you can validate a market in 30–45 days and make decisions based on data, not intuition. 📊

And with a tool like Waalaxy, you can launch and test your international campaigns in minutes without technical headaches. 🕺🏻

International growth isn’t about guessing. It’s about building a repeatable system that scales. 🌍

Frequently asked questions (FAQ)

Do You Need to Open a Local Entity Before Prospecting?

In most cases, no. ❌

You can test a market remotely using digital prospecting (LinkedIn + email), invoice through your existing entity, and validate traction before investing further. 🥸

Opening a local entity makes sense when 👇🏻 :

- You’re generating consistent recurring revenue.

- Local regulations require it.

- You manage a sales team locally.

- Your customers require a local presence.

👉 Prospect first. Structure later.

Does international business development work for all industries?

Not in the same way but yes, it works in most industries. 😇

It’s especially effective for 👇🏻:

- B2B SaaS.

- High value-added services.

- Digital solutions.

- Products or services that don’t require complex logistics.

However, in heavy industry, highly regulated sectors, or markets that require strong field presence, digital prospecting usually needs support from local partners, trade shows, or on-the-ground networks. ✨

How to become an international business development manager?

To become an international business development manager, you don’t need a super-specific degree but you do need strong experience in B2B sales, growth, or market expansion. 🌍 Most professionals start as SDRs or business developers before taking ownership of international sales and buisiness development. What really matters? Your ability to generate revenue and structure expansion strategically.

This role blends execution and strategy. You’re not just closing deals you’re deciding where and how to grow. You need to be comfortable with business development strategy :👇

- 📊 Tracking KPIs.

- 🚀 Building and optimizing multichannel outbound campaigns.

- 🌍 Adapting messaging to different cultural environments and marketing channels.

- 🧠 Prioritizing markets based on data, not intuition.

- 🔁 Testing and refining your approach continuously.

What works in one country might fail in another and adaptability is your biggest asset.

You now have the framework to approach international business development with clarity and confidence. 🧚🏻♀️