You are looking for a better understanding of “selling price“, you are asking yourself questions like “What selling price to set?”, “What are the best pricing strategies?” “How to know the right selling price?”. Then you’ve come to the right place. Find out how to make sure you’re going to make a profit. 😜

What is the Selling Price?

How to set a Sales Price?

This is a crucial step in selling a product or service, whether it’s a business or a self-employed entrepreneur.

Here are some steps to follow : 👇

1) 👩🔬 Analyze market prices like a scientist:

- That is, the prices charged in the market by competing companies, direct and indirect. This will help you determine if your price is competitive or not (we’ll see later in the article that you don’t need to match the price of a competing product!).

2) 🧑🏫Calculate your costs like a math teacher:

- Knowing your production costs, direct and indirect expenses, and profit margins is essential to determining the selling price. Make sure you take into account all the costs associated with producing, selling and distributing your product or service.

3)👨💼 Set your profit goal like an entrepreneur:

- Determine the profit you want to make on each sale and add it to your costs to get the final selling price. You have to set your own criteria and for that, you have to know the pricing strategies (we’ll talk about it soon)!

4)🕵️ Evaluate the demand and the profile of the buyers, like an investigator:

- The demand for your product or service can also influence the price. If demand is high, you can set a higher price, while if demand is low, you may need to adjust your price downward. On top of that, if you sell luxury products, for example, the quality justifies the high price!

5)🧝 Review your strategy regularly as an exporter:

- Keep in mind that the market is constantly changing, and prices can fluctuate depending on competition, supply and demand. It is therefore important to regularly readjust your pricing (and your overall business management) to stay competitive.

👉 By following these steps, you will be able to determine a selling price that will allow you to make a profit while being competitive in the market.

How to calculate the Selling Price of a Product?

You will have to list the indirect and direct costs as precisely as possible! Let’s take the example of a case study. Imagine that you sell prospecting software (CRM).

1 🥇) Identify direct costs:

For CRM software, direct costs can include the salary of the developers who worked on the software, the cost of cloud hosting, the cost of maintaining and updating the software.

For example, if the total developer salary is $100,000 and the software is hosted on the cloud for $10,000 per year, and the maintenance and update costs are $20,000, then the total direct costs would be $130,000.

2 🥈) Identify indirect costs:

For CRM software, variable costs can include marketing and advertising costs, legal fees, taxes, insurance, etc.

For example, if marketing and advertising costs are $50,000, overhead costs are $30,000, legal costs are $10,000, taxes are $15,000, and insurance is $5,000, then the total indirect costs would be $110,000.

3 🥉) Calculate the direct and indirect costs per unit:

Let’s assume that the competition sells the same products for around $300, then we can imagine how much software we would have to sell to “break even.”

($130,000 / 1,000 units) = $130 direct costs per 1,000 sales.

So far, so good.

Using the same example as before, the indirect cost per unit would be $110 per unit ($110,000 / 1,000 units).

Finish by ✅ Adding the direct and indirect costs:

Adding the direct costs per unit ($130) and the indirect costs per unit ($110), the total cost per unit would be $240, (assuming you sell at least 1,000 units).

This cost can potentially increase if you sell more software (need more developers to update the tool, need more advertising to develop in some countries…)

As we said, you always have to double-check your strategies and your sales to set a product.

How to calculate Selling Price from Cost and Margin?

The trade margin is important for several reasons:

Reason 1 🥇 It’s your only way to be profitable:

The margin percentage helps determine the profitability of the company’s business. If the sales margin is low, the company may struggle to cover its costs and make a profit.

In general, qualitative products that sell little have a high markup to ensure profitability, conversely, everyday products will cost less, and you will need to sell more to make your year!

Reason 2 🥈 This is your lever to be competitive:

The competitiveness of the company in the market will depend on its sales strategy. If the sales margin is lower than its competitors, the company may face difficulties in maintaining its market position.

Reason 3 🥉 It allows you to vary :

This is the only room for maneuver you have (it is much easier to vary the margin than fixed costs) it can help make decisions on sales prices and therefore the company’s strategy more globally.

To learn all about sales margin, follow the link. 👀 Otherwise, here is a summary. 👇

For example, if the production cost of a product is $240 and the selling price is $300, the sales margin will be $60.

It is important to note that the sales margin does not represent the net profit of the company, as it does not take into account other costs such as marketing costs, overhead, taxes and fees.

In order to calculate the net profit, you will need to subtract all the company’s costs.

To calculate your profit, it’s simple: (Product Selling Price – Costs) x Items Sold. 😜

To use our example on prospecting CRMs, it will be (300 – 240 x 1000) = $60,000 profit!

Why is it so important to Fix the Right Profit Margin?

The profit margin is important because it determines how much profit a business makes on each sale. 🤑

A higher profit margin means that a business is making more money on each sale. It also means that the business can cover its operating expenses more easily and have more money left over for investments or other purposes. Your pricing strategy is one of the most important marketing strategies to think about before launching a new product. 🚀

Let’s check out a few ideas for your pricing now. 😍

Resume: The important Calculations for a Selling Price Strategy

Here you can find a few ways of calculating costs and margin, it will help you to set up the perfect sale price!

- Trade Margin = Selling Price – Cost of Production.

- Profit Margin = (Income / Sales) x 100.

- Gross Margin = (Total Sales – Cost of Goods Sold) / Total Sales.

- Breakeven Point (in units) = Fixed Costs / (Price per Unit – Variable Costs per Unit).

- Markup Percentage = (Selling Price – Cost of Goods Sold) / Cost of Goods Sold.

- Profit = Total Revenue – Total Costs.

- Contribution Margin = Selling Price – Variable Costs per Unit.

- Price Elasticity of Demand = (Percent Change in Quantity Demanded) / (Percent Change in Price).

I will tell you in the article why all those formulas are important and how they help you fix your pricing!

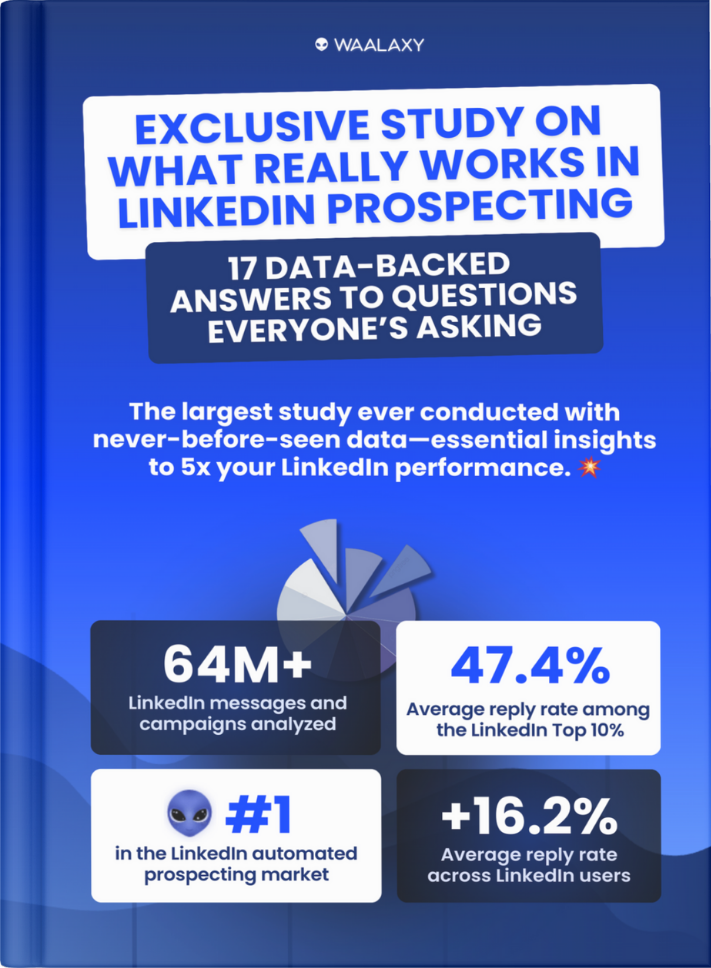

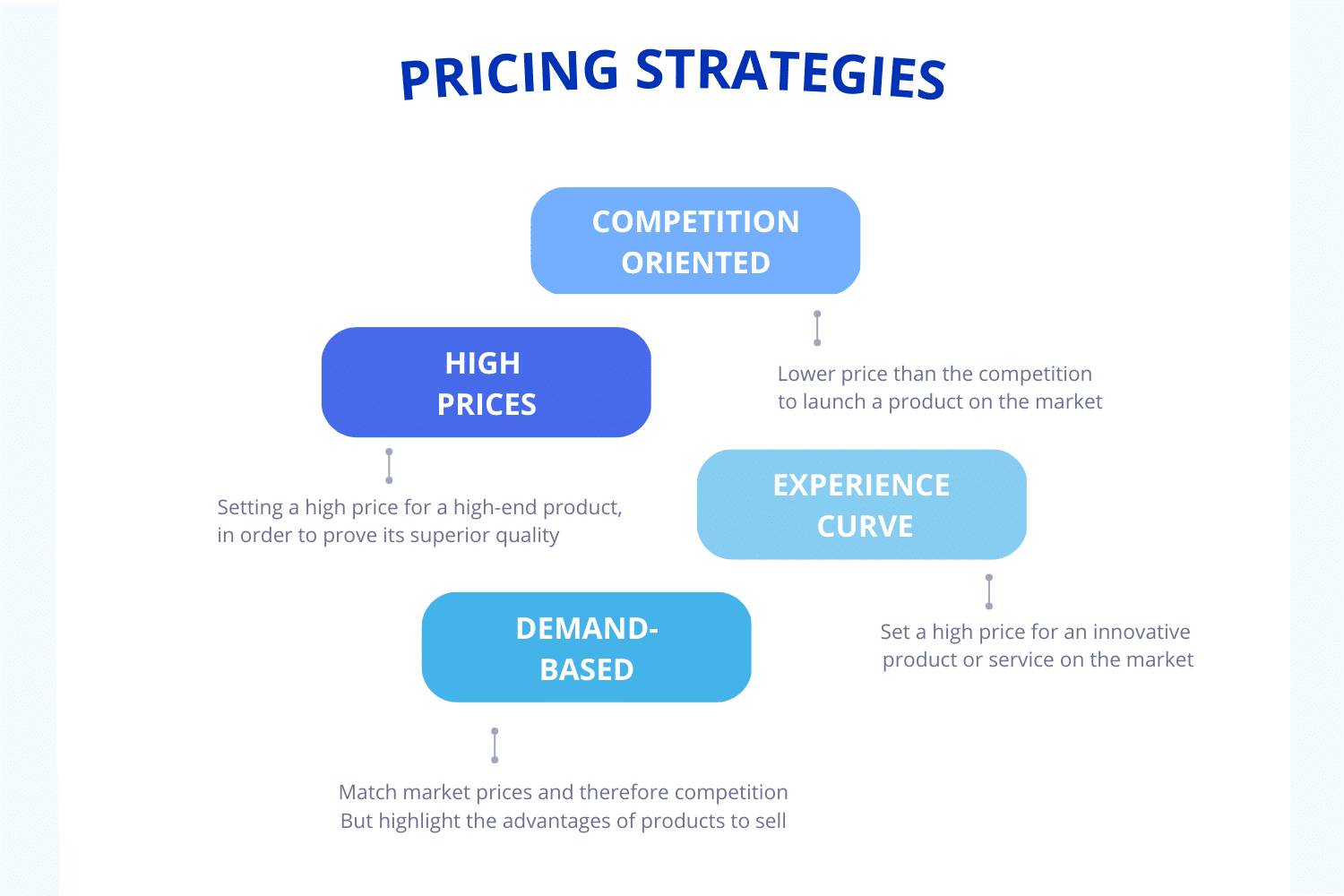

What are the Strategies for setting your Sales Prices?

There are several marketing strategies that companies can use to achieve different marketing and sales goals.

Among these examples, the most known are:

- Premium/ High Pricing – Choosing a higher price than the competition to position the product or service as higher quality, luxury or exclusive.

- Competition-Oriented Pricing – This is setting a very low initial price to quickly penetrate a market or attract price-sensitive customers.

- Experience Curve Pricing – Setting a high initial price for an innovative and unique product or service, often the second phase is to gradually lower the price to reach a wider audience.

- Demand-Based Pricing – This involves aligning with the market (and therefore the competition), focusing on the quality of the product and not the competitive price to sell it.

Go further in your Pricing Strategy

You can also think beyond the classical strategies.

My favorite strategy is the Yield management pricing!😉

It’s a strategy of instituting different prices for different customer segments or different buying times. For example, an airline may change its prices for airline tickets depending on the time of year or time of day. You can choose to modify the price list according to the season, an event, or the type of customers…

By the way, there is an article dedicated to this strategy, if you are interested!

Conclusion: How to Determine the Selling Price?

This is generally determined according to the production costs, the desired profit margins, the competition, and the market demand. Companies must also consider factors such as economic conditions, tax policies and government regulations.

The selling price for the company will therefore be the buying price for the customer! 💡

Article FAQ

What is the role of the Selling Price in the Marketing Strategy?

The selling price is an important component of a company’s marketing strategy because it can affect the customer’s perception of the value of the product or service. Price can also influence competition, profitability and market position. 🎯

What are the risks of a Selling Price that is too high?

If the selling price is too high, customers may be deterred from purchasing the product or service because it may be perceived as too expensive or not profitable enough compared to the competition.

What are the risks of a Low Selling Price?

If the selling price is too low, it can affect the perceived quality and profits of the company. You’re going to have to sell a lot to be profitable and consistently maintain that flow. 😰

What is the Break-Even Point?

It is the level of activity that allows, thanks to the margin achieved, to make a profit (to start being profitable).

The calculation is as follows = Fixed costs / Margin rate on Variable Costs.

Knowing the break-even point is important for your company because it helps a business understand how many goods/services it needs to sell to cover the costs of production. Once the break-even point is reached, any additional sales will result in profit for the business.🤑

What is the Gross Margin?

To calculate the profit margin, the gross profit is divided by the sales revenue. The gross profit is the amount of money left over after subtracting the cost of goods sold from the total sales revenue. The gross margin is the percentage of the gross profit divided by the total sales revenue.

What is the Net Selling Price?

The net selling price is the actual selling price (it’s just another terminology for some businesses). In some cases, as in a real estate transaction for example, agency fees apply, that’s why we talk about net selling price (really perceived by the seller).

What is the Difference Between the Selling Price Before and After Tax?

The before tax price means “excluding state taxes”. It is generally intended for negotiations between professionals. (it is on this price that you must calculate your margin). The after tax already contains the taxes, it is the one that consumers will really pay. 🤌

How to Adjust the Selling Price?

Businesses can adjust the selling price according to market conditions, customer demand, and competition. It is important to regularly monitor the market and costs to ensure that the selling price remains competitive and in line with customer expectations.

How to Change Pricing after Landing a Product?

Yes, of course, you can, and you should! Pricing and the market evolve with time, you need to keep looking at your selling volumes and see if it changes.

Sales volume is a key factor in determining the selling price, profit margin, and break-even point for your business. The more you have data, the more you can make informed decisions about production, pricing, and marketing strategies to increase revenue and profitability. (The calculation “price elasticity of demand” will help you to get data!)

You can also change pricing depending on your notoriety, the more the brand becomes famous, the more you know that the customers will pay higher pricing for your products. 😎

Determining the selling price is a major act in your company’s strategy, so don’t neglect it. 😜