If I tell you about an indispensable step of a company, what do you think of? 🤔 Yes, we are talking about the how to create an invoice ?

In this article, we will discuss the following:

- How to make a invoice?

- An example of a downloadable and editable invoice.

- Why make an invoice ?

- The different types of invoices.

- The mistakes to avoid.

- And finally, 3 invoicing software.

Ready to learn more? Let’s get started! 🚀

How to make an invoice template ?

Invoicing is an essential step in the life. It allows to justify sales and receipts to the tax authorities, to protect against possible disputes with customers or suppliers, to strengthen the commercial relationship and to monitor the evolution of the activity. However, invoicing can be complex and time-consuming.

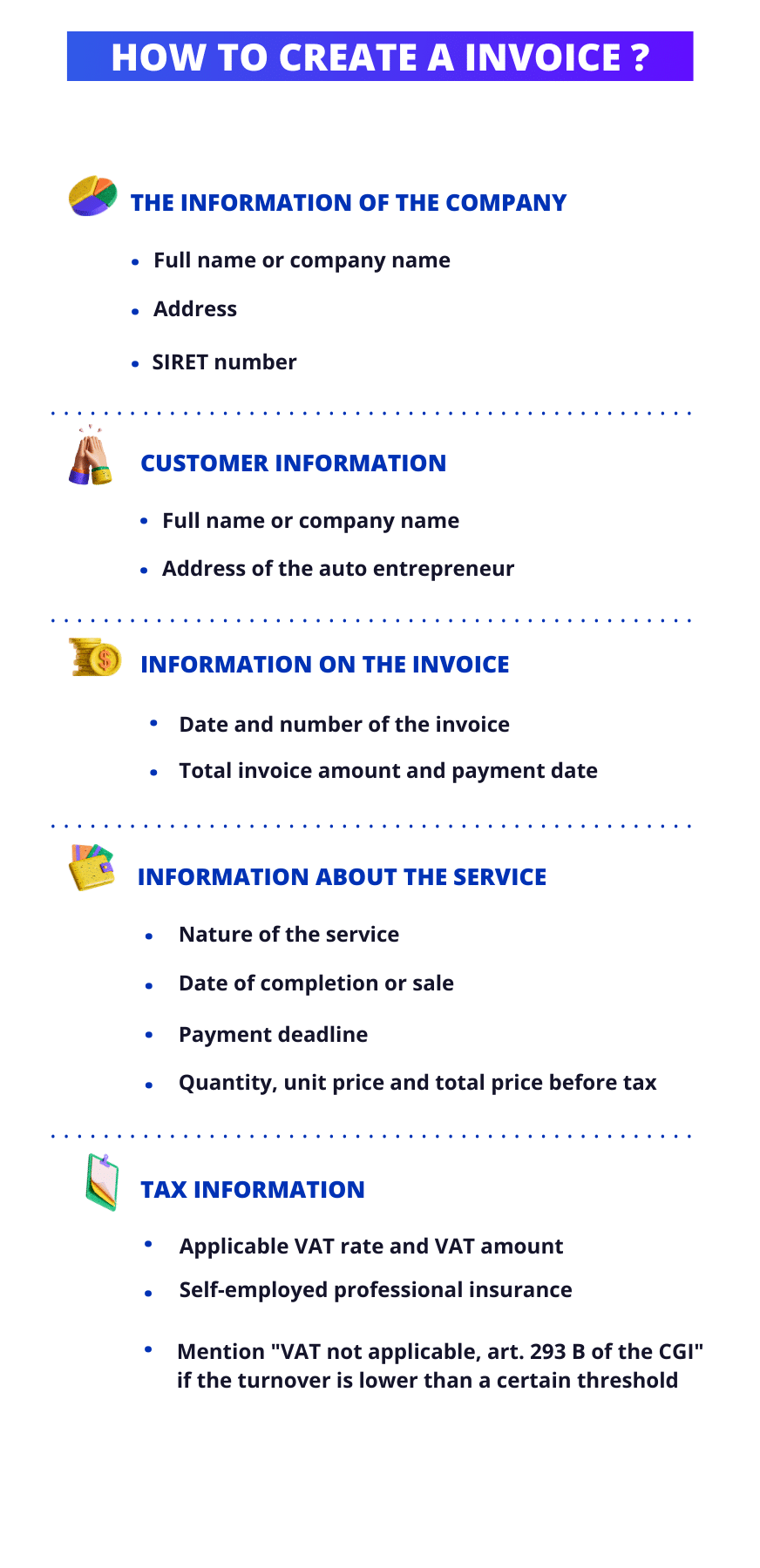

What are the mandatory mentions of the invoice?

That’s why we’re here to help you, and we’ll explain step by step how to make a invoice! 🥰

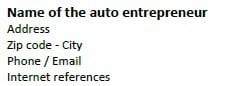

1) The information of the company

The contact information of the company must appear at the top of the invoice, even before the invoice number and the date of issue. This contact information must be complete and accurate, so that the customer can easily contact the company if needed.

It is important that this one mentions are :

- Name and surname or its company name. 💭

- Mailing address. 📍

- SIRET number. 🔢

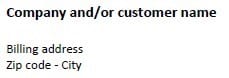

2) Client information

It is important to mention the customer’s details on the invoice so that the customer can easily identify the sale. The customer’s name and address must be listed accurately. 🎯

It is also possible to mention a phone number or an email address. ☎️

3) Information on the invoice template

The first compulsory mention on the invoice concerns the date of the invoice. This date is important because it allows to determine the deadline for payment of the invoice. 📆

This payment period is set by law and depends on the sector of activity of the company. In general, this period is 30 days from the date of receipt of the invoice.

Then, the invoice must be numbered. This number is unique and allows to identify the invoice, it can be composed of numbers, letters or a combination of both. Finally, we have the amount of the invoice. This amount should be specific and detailed so that the customer can understand the details of the invoice. 👀

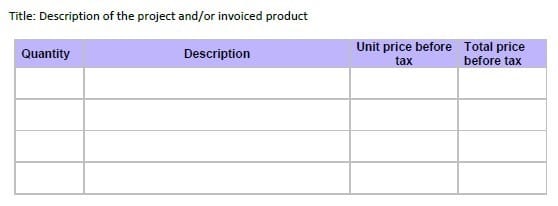

4) Information on the service provided

This part is essential because, it allows to justify the total amount of the invoice and to describe precisely the service provided. 🔍 The description of the service must be clear and precise in order to indicate the exact nature of the service.

Here are two examples to understand:

- 🟦 If the company provides translation services, it is important to mention the source and target language as well as the number of words or pages to be translated.

- 🟦 If the company provides graphic design services, it is important to mention the exact nature of the project (logo creation, flyer design, number of mock-ups to be provided).

Also, we have the unit price that must be consistent with the rates practiced by the company and it must be mentioned excluding taxes. In case of discount, do not hesitate to notify it! 🔔 Finally, do not forget to mention the total amount of the service provided. This should be calculated by multiplying the unit price by the quantity or number of hours of work performed.

Example of an free invoices templates

You know by dint of it, we like to spoil you. 🎁 That’s why, after explaining in detail how to make an invoice, we offer you an free invoice template in different formats, namely: word, pdf, excel. ✨

To begin with, here in spreadsheet form that you can copy and paste easily. This is an example of an invoice for the creation of a website :

| Company |

|---|

| Name : [Name of the enterprise] |

| Address : [Address of the company] |

| SIRET number : [SIRET number of the enterprise] |

| Client |

|---|

| Name : [Client’s name] |

| Address: [Client’s address] |

| Details of the services provided | Amount before tax (in euros) |

|---|---|

| Conception and design of the website | [XXX] |

| Development of the website | [XXX] |

| Integration of contents | [XXX] |

| Website referencing | [XXX] |

| Training in the use of the website | [XXX] |

| Terms of payment |

|---|

| Payment shall be made [specify payment terms: down payment, installment payment, accepted method of payment, etc.] |

How to create an invoice in word ?

Using the Word format for your invoices allows you to customize your invoice template to your image. You can add your logo, your colors as well as your font so that it is consistent with your corporate identity. This format is, as you can imagine, easily modifiable, so you can easily adapt your invoice template according to your needs and the specific requests of your customers.

Thanks to Word, you will be able to keep a history of your invoices in one place, handy for archiving or finding some old invoices if needed! 👀

If you are interested in this free template, just click on the button below! ⬇️

Invoice template in Word formatHow to create an invoice in PDF ?

Another known format, the PDF. This guarantees the integrity and security of your invoice because it allows you to export your invoice in an unmodifiable format, thus avoiding any unwanted changes to the document and unpleasant surprises! Moreover, the PDF format is compatible with all operating systems (PC, IOS, Inux), which guarantees that your invoice will be visible and usable by all your customers.

To download the free invoice in PDF format, go here! ⬇️

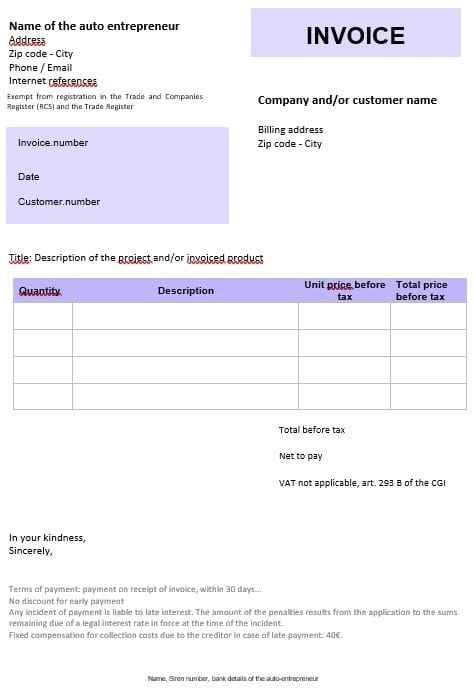

Invoice template in PDF formatHow to create an invoice template in Excel ?

Last format, Microsoft Excel. Nowadays, Excel is not what it used to be, namely a Chinese puzzle. Now you can edit, format and customize your tables to your heart’s content! 🦋

Here’s what an invoice looks like in Excel format, to download and edit it, it’s this way! 👇🏼

Invoice template in Excel formatWhy make an invoice template?

It seems obvious, but some may ask the question. Well, it is an essential document, which allows them to justify their sales and their income to different companies, from 4 different angles, namely, fiscal, legal, commercial and accounting.

Here they are in detail! ⬇️

#1. Fiscal point of view

The invoice allows you to justify your sales and receipts to the tax authorities. It must contain certain mandatory mentions to be considered as valid and thus.

Beware, the absence of an invoice can lead to tax and even penal sanctions. So make sure you keep them for at least 6 years, in accordance with the tax regulations in force. 🧑🏼💻

#2. Legal point of view

From a legal point of view, the invoice can be used as proof of the existence of a contract between the company and his client. In case of a dispute, it can be used to prove that the service has been performed and that payments have also been made. 💰

This one must thus be delivered within the time limits and must include obligatory mentions (those higher in the article). 😎

#3. Commercial point of view

Let’s move on to the commercial point of view. The invoice allows to present a professional and serious image to his customers. The latter can quite use it as a communication medium, mentioning for example his contact details, his logo and even a detailed description of the service performed. 👀

This helps to retain existing customers and attract new ones. 🔗

#4. Accounting point of view

Finally, from an accounting point of view, the invoice is a central element of the financial management. It allows to follow the financial flows of the company, to generate performance indicators and to prepare tax returns.

The invoice must therefore be kept carefully and be integrated into the company’s accounting follow-up. 📊

Finally, it can sometimes be used to manage unpaid invoices, by sending back, for example, reminders or initiating collection actions. 💭

The different types of invoices templates

You are not unaware that there are different types of invoices depending on the situation. They vary according to the nature of the service provided, the client, but also the legal obligations. Don’t panic, here are the details of the different types of invoices! 👇🏼

Classic invoice

This is the most common type of invoice, because it allows the company to invoice the entirety of his service or product in one go. However, it must contain all mandatory legal mentions (name and address, SIRET number, total amount of the service). 🌟

Invoice on account

This invoice is used when the company needs to be paid in installments for a service by a client. This allows to collect a deposit at the time of the order, then the balance at the end of the service. Don’t forget to include the legal mentions, but also to specify that it is a deposit invoice. It would be silly to forget that! 🧠

A little information, this invoice is issued at the time of the order and allows the enterprise to collect part of the total amount of the service before starting work.

Progress invoice

Here, we are talking about a project that takes place over a long period of time. Indeed, the progress invoice allows the company to invoice a part of the total amount of the service according to the progress of the project.

This one must be issued at each important stage of the project. 📝

Balance Invoice

The second to last one, the balance invoice. This one is issued at the end of a service when the balance is to be paid by the client and the client has validated the quantity of work done. 😇

Credit note invoice

Last but not least, the credit invoice. This one is issued when the company has to refund a part of the amount invoiced to the client, either in case of cancellation of the service or in case of a dispute. ❌ As you will have understood, it therefore allows the enterprise to regularize the situation and make the refund.

Mistakes to avoid on an invoice

Well, you will have understood, invoicing your services is a crucial step for enterprise, because it allows you to bring in money in the coffers and to guarantee the future of your company. 😇

Nevertheless, a poorly drawn up invoice can cause problems, especially in case of a tax audit. That’s why, here are 3 most common mistakes to avoid. ⬇️

Calculation errors

It may seem trivial to you, but it is important to check the amounts indicated on the invoice to avoid calculation errors. There is nothing more embarrassing than having to redo an invoice because of a calculation error, right? 🥲 For this, you can use an invoicing software that will automatically perform the calculations.

The errors of mention

Obviously, errors in mentions are common and it is easy to make them. It is therefore important to check that all the mandatory mentions are present on the invoice.

Format errors

Finally, the format errors. Well yes, it is important to respect a standard format for the invoices, in order to facilitate their treatment by the accounting services of the customers, such as PDF, Word or even Excel.

Conclusion

We are coming to the end of this article! We hope that all the information we have given you has been useful and has allowed you to better understand the issues and good practices related to invoicing.

As a reminder, invoicing is an essential element for your business. It allows you to formalize your commercial relationship with customers, to avoid any dispute and especially, to guarantee a better management of your cash flow. 🏴☠️

However, it is important to respect certain rules and compulsory mentions so that your invoice is valid. Fortunately, thanks to modern invoicing tools, it is easy to generate invoices that comply with tax and legal requirements in just a few minutes! 🥰

So make sure to take care of your design and its aesthetics so that it reflects your brand image and makes your customers want to come back to you.

Can I create an invoice myself ?

Sure, as for a self-employed entrepreneur, a micro-business or a company, must deliver to its customers an invoice for each sale or service rendered.

The invoice must be written in French, in two copies and be established on a paper or electronic support, without forgetting to keep it for at least 10 years from the end of the service. 🗓️

How do I create a simple invoice for free ?

If you want to create simple invoices for free, you can use the free version of Word or Google Sheet, you enter your information and you just have to export it in PDF format! ✨

Is there an invoice template in Word ?

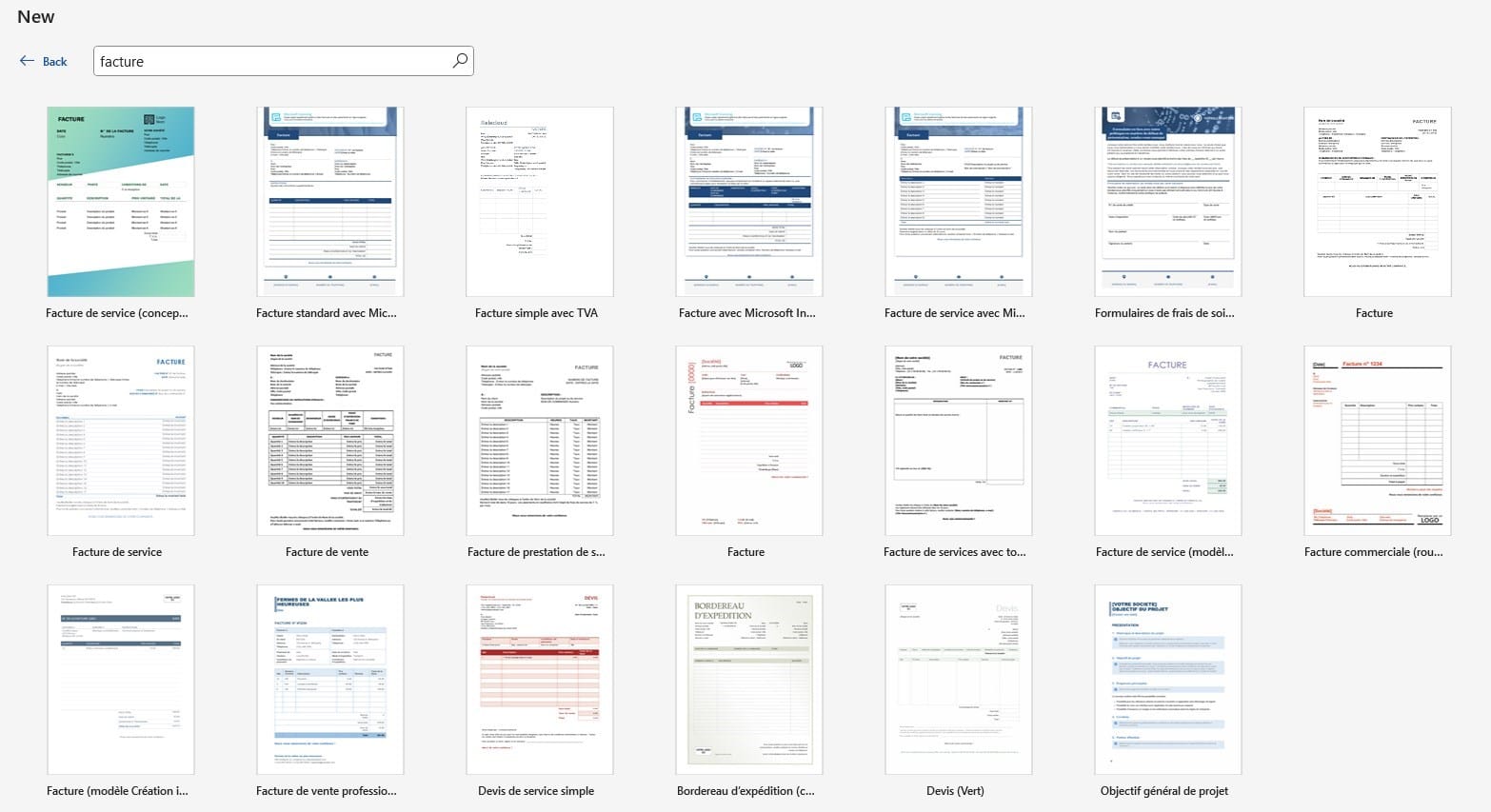

Did you know that on Word, you have access to existing auto entrepreneur invoice templates ! 🥰

To access them, nothing could be easier, just go to the home page, search for a template, here it will be “invoice auto entrepreneur” and hop, magic, lots of templates are available.

Hey there, you now know everything about how to create a invoice. See you soon and happy invoicing! 😎