If you’ve clicked on this article, you’re probably wondering what the difference is between revenue vs profit. That’s why we’re here! Today, we’re going to cover the following points:

- The definition of revenue

- The definition of profit

- The difference between the two

- How to calculate gross revenue and gross margin.

- What factors can affect revenues and profits?

Come on, don’t waste a second, let’s get started! 🚀

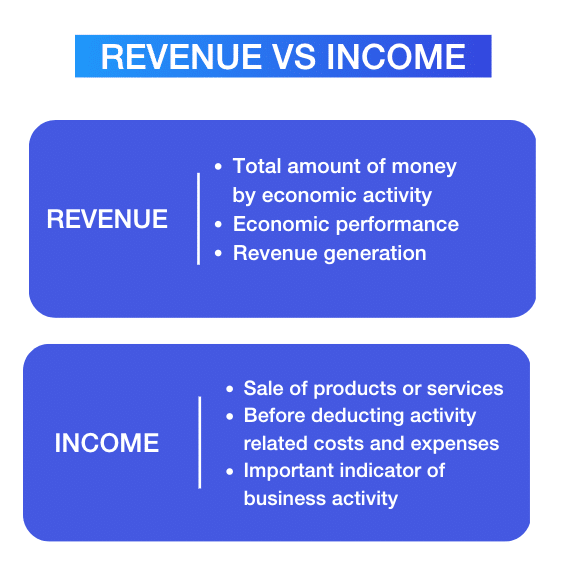

Revenue Definition

In the professional context, whether you’re a company or a freelancer, revenue is generally the total sum of money generated by a commercial or professional activity, before all charges and other deductions. 💸

In fact, income can come from various sources, such as:

- 🟣 Product sales.

- 🔵 Provision of services.

- 🟣 Employment contracts.

- 🔵 Consulting contracts.

- 🟣 Copyrights.

- 🔵 Royalties.

Income is essential in a business to assess the economic viability of a company or self-employed person. It can, in fact, vary according to various factors such as sales volume, prices charged, market demand, product or service quality or customer loyalty. 👀

Finally, it’s a key indicator for assessing the financial performance of a company or self-employed worker. 💻

Profit Definition

Profit is simply, the amount of money left over after deducting all expenses and costs related to business or professional activity from total income.

So, to cut a long story short, it represents the net gain made after covering all expenses. When we say expenses, we mean :

- ◾️ Production costs.

- ◾️ Overheads.

- ◾️ Salaries.

- ◾️ Taxes.

- ◾️ Marketing costs.

- ◾️ Equipment rental costs.

- ◾️ Administration and management expenses.

Note that profit is not simply income left over after paying personal expenses.

No, it’s a financial measure that takes into account all expenses related to the professional activity in order to determine the real profitability of the business or self-employed person. 👀

The difference between Revenue vs Profit

The difference between revenue vs. profit lies in how they are calculated and what they represent in the context of a company’s finances. 🌐

Indeed, revenue refers to the total amount of money generated by a company through economic activity, while profit is the amount of money left over after subtracting all expenses and costs associated with business activity. ✨

Income is a measure of revenue generation, while profit measures the actual profitability of the activity after considering the costs and expenses incurred. 😇

What is net revenue vs. net income?

Generally, the difference between the two lies in the context in which these terms are used.

Revenue refers to the cash inflow generated by the sale of goods or services, as it represents the total amount of sales or transactions made by a company over a given period. They can include :

- 🛍️ Product sales.

- ⏱️ Fees for services.

- 🏠 Rental income.

- 📺 Royalties.

Revenue, on the other hand, is a broader term that, while certainly encompassing receipts, can include other sources of income.

As a reminder, income represents the total amount of money generated by a company or individual through its economic activity, such as :

- 🔵 The sale of products.

- 🟣 The provision of services.

- 🔵 Employment contracts.

- 🟣 Copyrights.

- 🔵 Dividends.

Gross revenue vs. gross profit: How to calculate?

Now that you know more about the difference between profit and revenue, here are the different formulas for successfully calculating them. 🦋

Gross revenue

If you want to calculate your company’s gross revenue, here’s the formula! ⬇️

Yes, that’s right, the formula is as simple as can be! In fact, all you have to do is add up the total amount of each individual sale made by your company over a given period. You can easily add as many sales as you need, remembering to separate them with (+) signs.

To illustrate what we mean, here’s an example. 👇🏼

If a company has made the following sales :

- 🥇 Sale n°1: 1,000$.

- 🥈 Sale n°2 : 1 500$.

- 🥉 Sale n°3 : 2 000$.

The calculation of this revenue would therefore be: 1,000$ + 1,500$ + 2,000$ = 4,500$.

This means that the company’s gross revenue for this month is therefore 4,500$. ✨

Gross profit

Now let’s move on to the formula for calculating gross profit. ⬇️

As you can see, gross margin does not consider other expenses, such as overheads, salaries, taxes, or marketing costs. It focuses solely on costs directly linked to the goods sold. 💰

Using this formula, you’ll be able to assess your company’s basic profitability and thus determine whether the selling price of products or services adequately covers the associated costs. 👀

Here we go again with the examples. ⬇️

Let’s take the example of a jewelry manufacturing company with the following sales in a month:

- Total sales revenue = 10,000$.

In addition, there is the cost of goods sold:

- Cost of goods sold = 6,00$.

Let’s move on to the formula: 10,000$ – 6,000$ = 4,000$.

If we analyze the results, the jewelry manufacturing company’s gross margin is €4,000. This means that, after subtracting the cost of goods sold from its total sales revenue, the company achieves a gross margin of $4,000. 🦋

This gross margin represents the company’s basic profitability before considering future other operating expenses.

Revenue to profit calculation

So, revenue to profit is an ambiguous expression because revenue and profit are two distinct financial concepts. 👀

Indeed, sales (CA) represent the total amount of sales made by a company over a given period. It therefore corresponds to the sum of revenues generated by the sale of goods or services before any deductions.

Profit, on the other hand, is the amount of money left over after subtracting all expenses and costs ⚔️ related to the commercial or professional activity from sales.

Now that you’ve got the hang of it, we can move on to the formula for calculating profit in relation to sales.

A little hint: profit can also be calculated using other financial measures, such as net profit or gross profit. ✨

What are earnings vs. profit?

As you know, several factors can affect and influence a company’s various revenues. That’s why we’ve come up with 4 key factors that can have an impact 💥 on your revenues.

1) Pricing strategy: Revenue vs. margin

Pricing strategy can also have a direct impact on a company’s revenues and profits.

Indeed, a price that’s too high can reduce demand and thus lead to a drop in sales and, consequently, revenues. 📉

On the other hand, a price that’s too low can lead to low margins, significantly affecting profit. An appropriate pricing strategy, balancing customer perceived value and costs, to help maximize revenues and profits. 💡

2) Cost management

Good cost management is essential to maintaining healthy revenues and profits. Here’s a short list of things to keep an eye on 👁️ :

- 🔷 Production costs.

- 🔷 Raw material costs.

- 🔷 Overheads.

- 🔷 Salaries.

3) Sales and marketing efforts

Did you know that an effective sales force 🦾 can play a vital role in achieving revenue targets? 🧐

In fact, if you use effective marketing strategies, such as advertising, sales promotion, digital marketing, market segmentation or even customer targeting, you’ll be able to stimulate demand and thus increase sales. 📈

4) Operational efficiency

Last but not least, operational efficiency. Indeed, if you manage the operational side well, in this case, you’ll be able to increase your company’s profitability. It’s about little things like :

- inventory management. 📦

- Production planning. 🛄

- Logistics. 🖥️

- Resource management. 🌱

- Process automation. 🤖

- Time management. ⏱️

As a final word, we can say that a well-organized company can respond better to demand, reduce waste and thus optimize the bottom line. 💟

How about a recap?

As you can see, the aim of this article was to highlight the importance of taking a close look 👁️🗨️ at revenues and profits, while implementing appropriate strategies with the aim of maximizing a company’s profitability.

Here’s a quick reminder of the points we covered:

- 🔳 The definition of profit.

- 🔳 The definition of revenue.

- 🔳 The difference between profit and revenue.

- 🔳 How to calculate gross revenue and gross margin.

- 🔳 And finally, what factors are likely to affect revenue vs profit?

FAQ: Cash flow vs revenue

Don’t go away so quickly, we’ve still got a few resources in stock! 👇🏼

Is revenue the same as profit? Revenue minus expenses

The answer is no. Revenue describes the income generated by the company’s activities, while profit describes the net income after expenses have been deducted. ✨

What is the difference between profit and revenue?

Having profit higher than revenue is not possible, since profit is calculated by deducting expenses from revenue. Or else, expenses would have to be negative, which is not the case. 😎

And that’s it, that’s now the end of this article about revenue vs profit. See you later! 👋🏽