Do you know how to calculate customer lifetime value or, simply, what is it? 🤔

Successful companies are not those that focus solely on acquiring new customers, but those that know how to make the most of every customer relationship, thanks to Customer Lifetime Value.

If you’re completely unfamiliar with this word, then you’ve come to the right place.

Without further ado, let’s find out together what it is and how to calculate it. 🔥

Lifetime customer value: the definition

Customer Lifetime Value (CLV) is a measurement that estimates the total amount of revenue a customer can bring to a company.

It’s not just a one-off sale. Here, we take into account all future transactions, the frequency and recurrence of purchases. 👀

This enables us to assess the long-term profitability of customers, as we calculate the costs of acquisition and retention.

Roughly speaking, it helps to make strategic decisions, such as the marketing budget, or the loyalty program. 🦋

Why is CLV important?

Still haven’t grasped the importance of CLV(Customer Lifetime value)? 😲

Okay, don’t panic, we’ll explain it more closely. 🔎

1) Improve customer loyalty

If you understand the value a customer brings over the long term, you’ll be able to work harder on your loyalty strategies, such as :

- 🔷 Reward programs.

- 🔷 Personalized offers.

- 🔷 Quality customer service.

A high customer lifetime value indicates strong loyalty, which logically reduces the constant need for new customers (which can sometimes be very costly). 💸

What’s more, if you focus on improving Lifetime value, you’ll accentuate repeated purchasing behavior and therefore, extend the customer’s lifespan. ⏱️

As well as increasing revenue, this strengthens the customer-brand relationship.

2) Calculate company profitability

As you’ll have guessed, “customer lifetime value marketing” is a way of determining how much a customer really earns in relation to the costs invested in acquiring and retaining them. 🔥

If you’re a company with a high LTV 📈, you’ll be able to justify your marketing and service spending because you know that the costs will be amortized by the future revenues generated.

A little tip: if you combine LTV with other indicators such as customer acquisition cost (CAC), or churn rate, you’ll get an overview of your finances and make the right decisions! 👀

3) Optimize customer acquisition costs

You have two choices:

- 1️⃣ Your LTV is high ⭢ it’s possible to allocate more budget to marketing campaigns without risking losing money.

- 2️⃣ Your LTV is low ⭢ you need to rethink acquisition or retention strategies to improve profitability.

Optimizing CAC based on LTV improves the effectiveness of marketing spend by targeting the best customer segments.

By doing so, you can be sure that every euro spent on acquiring new customers contributes to your company’s growth. 😇

How to calculate customer lifetime value ?

I warn you, the calculation isn’t that simple (anyway, the hardest things to get are the best, right? 😇). This one is done in 4 steps, so take notes and pay attention! 🤫

1) Determine the average lifetime of a customer

💡 Customer Life Time = 1 / churn rate

The churn rate is the percentage of customers who stop doing business with the company over a given period. Inverting this rate gives an estimate of the average length of time a customer remains active. 👀

2) Calculate average purchase frequency

💡 Purchase frequency = Total number of purchases / Total number of customers

This formula is used to measure how many times a customer buys on average during a certain period. 📆

3) Calculate the average basket

💡 Average basket = Total revenue / total number of purchases

The average basket represents the average value of transactions made by a customer during a purchase. 🛍️

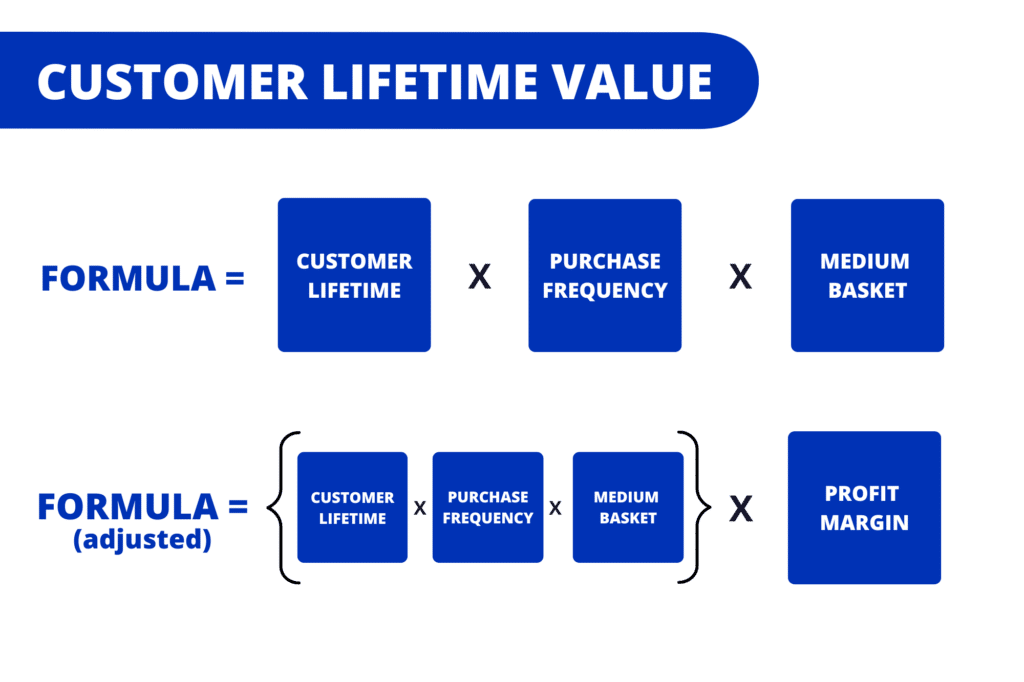

4) Calculate lifetime value

That’s it, we can finally get down to the formula! 👇🏼

💡 Customer Life Time Value = Customer Lifetime × Purchase Frequency × Average Basket

This formula makes it possible to estimate the total value a customer generates for the company over the entire duration of his relationship with it. 🔥

5) Take margins and costs into account

If you want a more accurate estimate, you need to take into account the profit margin (after deduction of production and acquisition costs). Here’s the formula: ⬇️

💡 Adjusted CLV = (Customer Lifetime x Purchase Frequency x Basket) x Profit Margin.

Calculating customer lifetime value Saas : example

To make things clearer for you, here’s a concrete example from a Saas company. Here’s the information we need to calculate Lifetime value of customers :

- 🟣 Monthly churn rate: 5%.

- 🟣 Total number of active customers: 1,000.

- 🟣 Total number of transactions (renewed subscriptions) over a 12-month period: 9,000.

- 🟣 Total sales generated over this period: €450,000.

- 🟣 Gross margin: 40%.

Let’s do the math! 🧮

- Average customer lifetime (1 / churn rate) ⭢ 1 / 0.05 = 20 months.

- Average purchase frequency (Total number of purchases / Total number of customers) ⭢ 9,000 / 1,000 = 9 purchases per year.

- Average purchase frequency (monthly)⭢ 9 / 12 = 0.75 per month.

- Average basket (Total sales / Total number of transactions) ⭢ 450,000 / 9,000 = €50 per transaction.

- LTV (Average Life×Average Purchase Frequency×Average Basket) ⭢ 20 x 0.75 x 50 = €750.

- LTV (after gross margin) ⭢ 750 x 0.40 = €300.

For this Saas company, the net Customer Lifetime Value of a customer is €300.

This means that each customer brings in an average of €300 in profit to the company over the lifetime of the relationship.

Case study: how does Waalaxy increase its lifetime value?

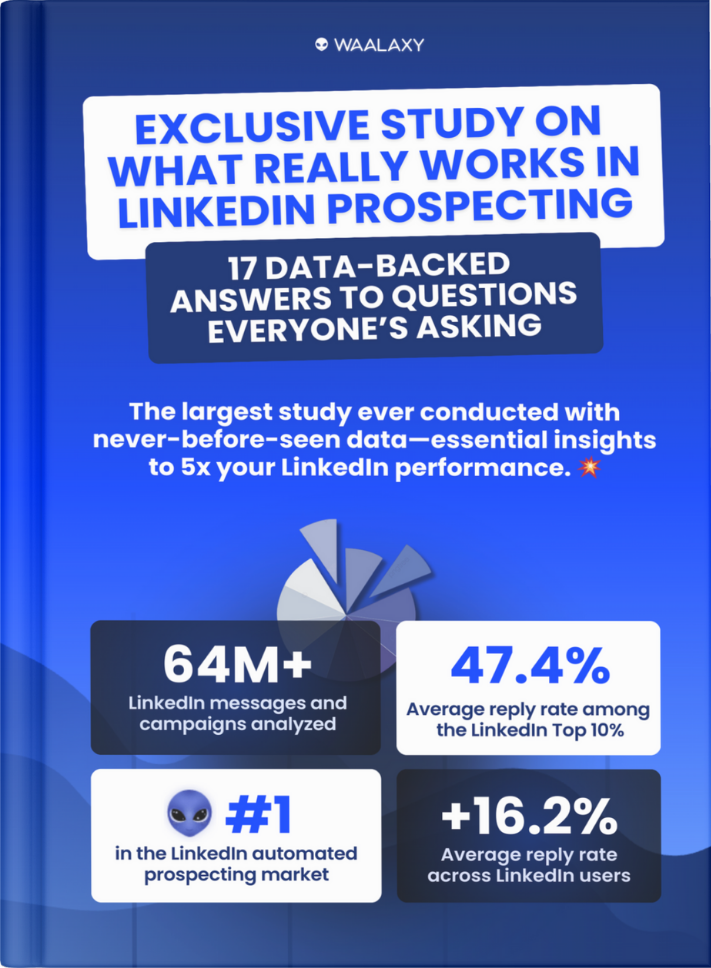

Waalaxy is a LinkedIn and email prospecting and automation tool designed to help companies generate and qualify leads efficiently. 👽

Thanks to automatic mailing campaigns, invitation requests or bulk messages, you’ll be able to easily find new customers and get responses.

The tool is secure, easy to use, requires no database or technical skills.

We’ll tell you how they increase their customer lifetime value! 😇

1) Continuous product improvement

Waalaxy constantly invests in the continuous improvement of its product with the aim 🥅 of increasing its customers’ LTV.

Its entire strategy is based on regularly adding new features and optimizing existing ones based on customer feedback. 😇

For example, they’ve released Waami, an AI assistant that helps write prospecting messages. ✨

How to do it? 🤔

Well, just fill in :

- 🔵 Your target audience.

- 🟣 Your value proposition.

- 🔵 Your differentiator.

- 🟣 A call to action.

And presto, the magic happens, and you’ve got a completely personalized prospecting message! 😇

But that’s not all. In addition to functionality, the user interface is continually refined to enhance the customer experience, making the product ever more intuitive and enjoyable.

By doing so, Waalaxy keeps its existing customers engaged and prevents them from seeking alternatives elsewhere. 🧠

2) Personalized offers

Rather than proposing a one-size-fits-all approach, Waalaxy segments its users according to various criteria such as purchasing behavior, sector of activity or product use.

By doing so, Waalaxy tailors its offers to the specific needs of each customer group! 😇

If you’d like to find out more about the different subscriptions, go here! 👇🏼

By increasing the relevance of interactions with each customer, it succeeds in prolonging the customer relationship, which (if you’ve been paying attention), increases customer lifetime value! 🥳

3) Upselling

If you’re not quite sure what upselling is, it’s about encouraging existing users to upgrade to more advanced plans or additional features that better meet their business needs.

For example, Waalaxy practices upselling when users reach the limits of their current plan or express a growing need for features. 👀

I’m thinking in particular of Inbox (LinkedIn’s messaging, but better, with more features and more filters), or extra credit email Finder (which allows you to use Email Finder).

By doing this, Waalaxy succeeds in prolonging their customers’ engagement and maximizing revenue over the duration of the relationship! ✨

4) Customer support

Waalaxy offers webinars and tutorials adapted to users’ different levels of proficiency.

This coaching helps reduce any friction customers may encounter.

Indeed, the automation tool maintains ongoing communication with its customers, regularly gathering feedback to further refine (like a knife 🔪 or a cheese 🧀, it’s up to you 😅) the product and user experience.

They also offer newsletters that give a wealth of advice, on their media, Supernova ☄️!

Here’s a non-exhaustive list of the newsletters they offer:

- 🥇5 steps to double your sales.

- 🥈How to set up your content strategy on LinkedIn.

- 🥉How to x2 the response time of your prospecting messages.

5) Bonus: win more customers by prospecting.

By automating repetitive tasks such as sending connection requests or personalized messages on LinkedIn, Waalaxy lets us focus 🧠 more on qualified leads.

In fact, you can integrate personalized prospecting scenarios, which saves you time, but which also allows you to target your prospects perfectly. 🎯

And if you’re still not convinced by prospecting, here are the advantages:

- Automation of repetitive tasks.

- Intelligent prospect segmentation.

- Large-scale personalization.

- Automated follow-up.

- Real-time data analysis.

Are you happy? Converted to prospecting? 👀

Ready for a recap?

As you can see, “customer lifetime value” is not just a financial indicator. It’s a real ⚖️ strategic lever for any company wishing to maximize its profitability and long-term growth. 📈

Every decision, whether it’s about acquisition, loyalty or cost optimization, must be taken after an analysis of CLV (customer lifetime value). 👀

Ultimately, it’s this long-term vision that will set you apart from other companies. ✨

Is 31 LTV good?

An LTV of 31 can be good or bad, depending on the context of the company, its field of activity and the costs associated with customer acquisition and retention.

If the cost of acquisition (CAC) is well below 31 (say 10), it means the company is generating a good profit on each customer acquired (which is positive). 🔥

On the other hand, if the CAC is close to 31 or even higher, this indicates that the company may be struggling to achieve sustainable profitability. 👀

In this case, you need to review your strategy. 😇

How do you estimate a customer’s lifetime?

Estimating the lifetime of a customer is a crucial process for calculating Customer Lifetime value and making strategic decisions. ⚡️

The most common method is to use the churn rate. Here’s the formula: 👇🏼

Average customer lifetime = 1 / churn rate.

For example, if a company has a monthly churn rate of 5%, the average lifetime of a customer would be 1 / 0.05 = 20 months. 😇

And there you have it, all you need to know about how to calculate customer lifetime value. 🐉