Do you know how to calculate churn, or don’t understand why you’re losing more customers than you’re gaining? Maybe because your churn rate is too high.

In an increasingly competitive world, you have only one objective: to keep your current customers.

And we’re here to help! 💡

Contents: 👇🏼

- Definition of churn rate.

- How do you calculate it?

- Average churn rate.

- 4 types of churn.

- How to lower your churn rate.

Come on, we’re not hanging around, we’ve got customers to keep! 👀

How to calculate churn?

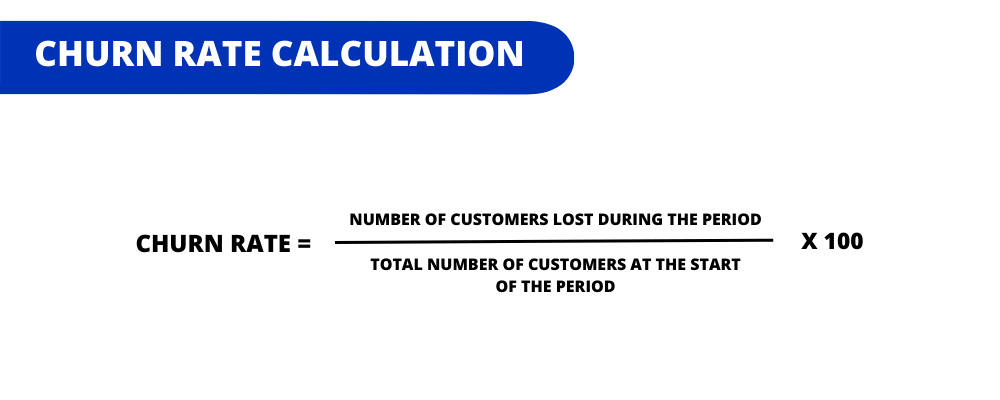

Churn rate calculation: (Number of customers lost during the period / Total number of customers at the beginning of the period) x 100

Before you start calculating your attrition rate, there are a few steps to follow. 👇🏼

1️⃣ Choose a period.

Determine the period you wish to calculate. This can be monthly, quarterly or annually, depending on your needs. This allows you to quickly adjust your retention strategy.

2️⃣ Identify the number of customers at the outset.

Feel free to note the total number of customers you had at the beginning of the chosen period. This number should include all active customers, not including new customers acquired during the period.

3️⃣ Count the number of customers lost.

Calculate how many customers no longer use your product or service during this period.

❌ But be careful not to count new customers acquired during this period, or the results will be skewed.

In addition to the churn rate, we recommend using these performance indicators to understand your company’s growth: ⬇️

- 🟣 Retention rate: this is the opposite of churn, as it measures the percentage of customers who remain loyal to a product or service over a given period.

- 🟣 Conversion rate: measures the percentage of prospects or visitors who carry out a desired action (sign up for a free trial, buy a subscription…).

- 🟣 Customer Lifetime Value (CLTV): estimate of the total financial value a customer brings to a company over the course of a relationship.

What is a churn rate?

Churn rate (or attrition rate for those in the know) means the percentage of customers or users who stop using a company’s products or services over a certain period of time.

This key performance indicator (KPI) is essential if you want to assess customer loyalty and the effectiveness of your retention strategies. 👀

This can be influenced by :

- 1️⃣ Customer satisfaction.

- 2️⃣ Product/service quality.

- 3️⃣ Customer service efficiency.

- 4️⃣ Competitive pricing.

If you can identify 🔎 the causes of churn, you’ll be able to bounce back by improving your product, adjusting your communication strategy, or even setting up a very specific loyalty program.

The attrition rate has a direct impact on revenues and can affect a company’s profitability.

What is a good attrition rate?

A good attrition rate varies according to several factors such as the industry, the company’s stage of development or even its model. 👀

However, a good attrition rate is estimated to be between 2% and 5%. ✨

However, this percentage can change depending on your sector of activity, and that’s what we’re going to look at right now. ⬇️

Average churn rate

As mentioned above, the attrition rate will depend on your field of activity. Here are a few examples to help you perfect your marketing strategy.

1️⃣ Enterprise SaaS (Software as a Service):

- For SaaS companies targeting small and medium-sized enterprises (SMEs), an annual churn rate of 3% to 5% is considered good.

- For SaaS companies targeting large enterprises, an attrition rate of around 1% or 2% is considered excellent.

2️⃣ Telecommunications:

- Telecom companies can see monthly churn rates of 1% to 2%, which equates to annual rates of around 12% to 24%.

3️⃣ Banking and financial services :

- These sectors often have a lower churn rate, around 5% to 15% annually, due to a more stable customer relationship.

4️⃣ E-commerce :

- The attrition rate can be high, often above 20% to 40%, due to competition and consumers wanting to switch brands.

5️⃣ Media and entertainment (including streaming platforms) :

- With the increasing number of offers and options available, churn rates can be as high as 5% to 10% per month.

The way the churn rate is calculated (customer churn / revenue churn) can influence the result.

Example for a SaaS company

What better way to illustrate my point than with an example? 👀

Let’s take the example of a SaaS company that provides cloud storage solutions to enterprises.

It wants to assess its monthly churn rate to better understand its customer retention performance and thus identify 🔎 opportunities for improvement.

Here are a few figures:

- Total number of customers at the beginning of the month: 800.

- Number of customers lost during the month: 40.

Now let’s move on to the formula for calculating the churn rate. 👇🏼

So here it would be:

Churn rate: (40 / 800) x 100 = 5.

What does it mean? 🤔

Well, the SaaS company loses 5% of its customer base every month. Over the course of a year, this means a significant loss of customers and revenue, especially if the growth rate of new customers isn’t high enough. 📈

To reduce this, this company can focus on improving customer satisfaction, offering loyalty programs, improving its product based on customer feedback or implementing a more efficient onboarding process for new customers. 😇

What are the 4 types of churn rate?

Did you know that there are 4 types of churn? No, well, I’ll explain them to you then! 😇

1) The transition to competition

First, we have the move to competition. This is when customers choose to leave a company to sign up with a competitor (betrayal, disgrace, the spirit of evil is branded on its face, I hope you get the ref 🦁). 😱

This form of churn is worrying, as it indicates a loss of customers, but also a potential gain for the competition.

What are the main reasons? Well:

- More competitive prices.

- Offers perceived as being of better quality or more relevant.

- A better overall customer experience.

To remedy this, you need to constantly assess your market position, ensure that your offerings remain competitive, and reinforce your customers’ commitment and satisfaction.

2) Abandonment

Secondly, there’s abandonment, i.e., the situation where customers stop using your product or service, but don’t switch to a competitor. This may be due to :

- 🟣 No longer needs the product.

- 🔵 Personal change.

- 🟣 Customer’s professional change.

- 🔵 General dissatisfaction.

But don’t panic, you can mitigate it by communicating better with your customers to understand and anticipate their needs.

3) Change of offer

Sometimes customers decide to change their subscription level or the types of services they have, often for a cheaper or less comprehensive offer.

While this is not a complete loss of the customer, it does reduce the revenue generated by the customer.

This type of churn shows that a personalized offer that better responds to customers’ needs and preferences would be more suitable.

4) Voluntary attrition

For the latter type, it’s the customer who decides to stop using a product or service, for example because of dissatisfaction with the product, or because the service is no longer useful.

If you want to remedy this, you first need to understand the reasons why the customer has left, and then implement a targeted strategy 🎯 to improve the customer satisfaction rate.

Customer churn VS revenue churn, what is the difference?

You’ve probably already heard the words Customer Churn and Revenue Churn, but you don’t know the difference between the two? 🤔

Well, don’t panic, that’s what I’m here for, I’ll explain it to you! ⬇️

Customer churn

Customer churn is a process in which customers stop using a company’s services or subscribing to its products. 👀

This can take the form of : 👇🏼

- Cancellation of a subscription to a service.

- Non-renewal of a contract.

- Choosing not to buy products.

This is a key indicator of customer satisfaction and loyalty, and can have a major impact on profitability and long-term growth.

Revenue churn

Loss of income refers to the reduction or absence of the income stream that a company, individual, or organization expected to receive. 👀

This situation can arise for various reasons, such as: ⬇️

- Decline in sales.

- Business interruptions.

- Regulatory changes.

- Customer churn.

How can you lower your churn rate for a SaaS business?

If you’ve just calculated your churn rate and realize that it’s not high enough, don’t panic, we’re giving you our tips for lowering your attrition rate right away, it’s a freebie. 🎁

1) Improve your customer support

I’m not telling you anything new, but exceptional customer support is essential if you want to reduce your churn rate. We’re fed up with 72-hour responses, we want speed, efficiency, and kindness! 👀

Okay, but, how do you set it up? 🤔

Already, you need to set up several support channels, such as live chat, phone, email, or even social networks. 🛜

Secondly, your employees must be constantly in training and know ❤️ your product or service by heart so that they can solve problems quickly!

Another nice hack is to use online knowledge bases or community forums. This way, customers can find answers to their questions on their own.

And finally, we can only recommend that you gather and act on customer feedback on their experiences

And finally, we strongly advise you to gather customer feedback on their experiences and act accordingly!

There are many ways to do this, including CSAT. 👇🏼

2) Choose a yearly subscription

Even if the price is at first sight much more important, engaging customers to choose annual subscriptions rather than monthly ones can considerably reduce your company’s churn rate.

Indeed, annual subscriptions are a bit like a serious relationship; trust is built over the long term, and it reduces the opportunities for customers to re-evaluate their decision and leave. 👀

Okay, but how do I do it? 🤔

For starters, you can inspire people by :

- 🥇 Add additional features.

- 🥈 Offering significant discounts.

- 🥉 Include exclusive services.

This increases your initial income and improves your company’s future cash flow. 💸

This way, you have more time to demonstrate the value of your product and perhaps increase the chances of long-term renewal. 🤞🏼

3) Automatic subscription renewal

Finally, this tactic is effective in reducing attrition rates, especially in the SaaS sector.

Why? It avoids the service errors that can arise between subscription periods, and which might prompt the customer to consider other options. 😅

But above all, it’s useful and practical for the user because he doesn’t have to think about when to renew or re-enter his bank card. It’s all done automatically.

If you want to carry out this tactic, you need to clearly communicate (I did say clearly 🦻🏼) the terms to customers, including how and when they can cancel if they wish, to avoid your customer suing you because you forgot to mention it.

If you wish, you can set a reminder before renewal to maintain a relationship of trust and ensure customer satisfaction.

How about a recap: How to calculate churn?

I think we’ve said it enough in this article, churn rate is a vital indicator 🫀 of your business.

If you want to build loyalty, think of these 3 golden words (or rather 3 golden tips):

- 1️⃣ Excellent customer support.

- 2️⃣ Encourage year-round subscriptions.

- 3️⃣ Add automatic renewal.

Each of these strategies builds a solid foundation for sustainable growth, satisfied and committed customers, and revenue stability.

Frequently asked questions

Hop hop hop, we’ve got a few more questions that, I think, might interest you. 😇

How do you analyze churn?

To analyze the churn rate, a few steps are necessary:

- Data collection.

- Customer segmentation.

- Identifying trends and patterns.

- Root cause analysis.

- Measuring the financial impact.

- A/B Testing and learning.

- Ongoing monitoring.

If you follow this plan, you’ll have a 360 tracking on your attrition rate. 😇

What is the relationship between churn and retention?

Churn and retention are like two sides of the same coin. They’re opposites, but they work together, and here’s why:

- 🟣 Opposite measure: when churn increases, retention decreases.

- 🔵 Balance: for the company to grow, you need to find the right balance and keep customers and lose as few as possible.

- 🟣 Indicators: churn shows how many customers leave, and retention shows how many decide to stay.

- 🔵 Cost: reducing churn is good for a business, as it costs less to keep an existing customer than to find a new one.

What is attrition?

Attrition, also known as “churn”, refers to the process by which a company loses customers or subscribers over time. 📆

This term is used in various sectors, such as telecommunications, financial services and subscription-based services like SaaS software.

Now you know all about how to calculate churn! 🐉