Wondering, how to get a startup business loan with no money ? 💰 Well, in this article we give you all the prerequisites for a loan, and all the other alternatives you have as an entrepreneur.

Let’s find out more ! 🏃

How to get a startup business loan with no money ? 4 Steps

You own a small business, and you’ve always dreamed of launching your startup but don’t have the necessary capital? 🙈 You may feel discouraged, especially considering the current economic climate.

But don’t give up on your dreams yet! 🙏 Believe it or not, you can get a start-up loan even if you don’t have any money. All you need to do is research the available options and plan carefully.

The purpose of this article is to take the guesswork out of finding and applying for a loan when you don’t have anything to put up as collateral. 👉 Read these tips on how to secure a startup loan successfully with no upfront payment.

1. Evaluate your assets

First, focus on improving your personal credit score. 🤔 You can do this by paying off your debts, making on-time payments, and monitoring your credit report.

Next, create a strong business plan that highlights your vision and growth strategy.

Third, gain as much industry experience as possible. This proves your expertise and commitment to business success.

Finally, providing collateral, such as real estate or equipment, can give lenders peace of mind and increase your chances of approval. ✔️

With hard work and dedication, you can overcome this obstacle and secure the financing you need to take your business to the next level. 🚀

2. Determine whether you’ll be able to repay

It is possible to start a business without money or income if you find the right loan. 👉 There are various options available, from invoice financing to startup loans.

Before you do anything, make sure you research your lender, understand the terms of the loan, and understand the repayment plan. 💡

3. Know a lender’s requirements

We know that it takes money to make money, but lenders also know that businesses without money or revenue still need capital to get their business off the ground. 🤌

However, lenders want assurance that a company will be able to repay the loan and interest over time. 👉 This is where revenue requirements come into play. Lenders want to ensure that a company can generate enough revenue to cover costs and debt payments.

For example, if a lender has a $10,000 monthly revenue requirement for a loan application, they will seek evidence that the business is generating at least that amount to approve the loan and ensure repayment. 🤝

4. Understand your own risks

Zero income loans often have higher interest rates due to the perceived risk. 👀 Additionally, you may be required to provide collateral with personal assets that may be at risk if the business is not successful.

Additionally, defaulting on your loan will be reported to the credit bureaus and can affect your credit score. 💹 This may make it more difficult to obtain financing for future operations.

Overall, you should approach startup financing without capital carefully and be aware of the risks before signing a loan agreement. 🥲 Research and compare different types of loans to find the best loan for your business.

With the right financing and a little effort, your entrepreneurial dreams can become a reality. 💫

How to get small business loan? Types of loans

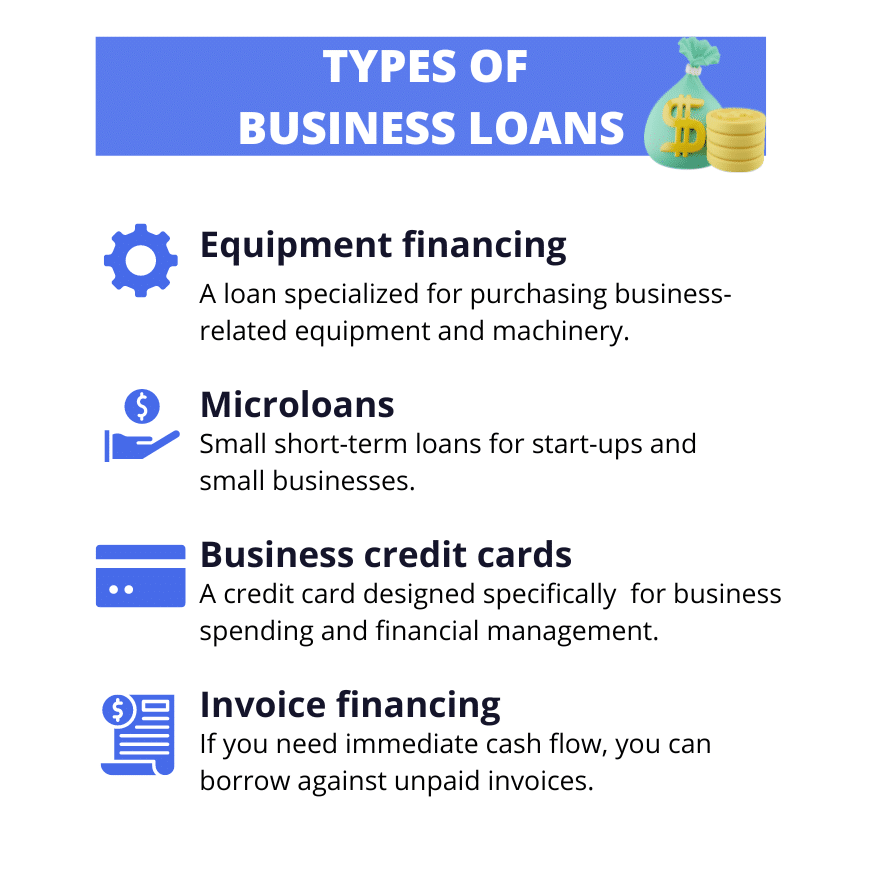

If you are starting a new business without significant capital, 🪙 it may be impossible to apply for a traditional loan from a financial institution due to strict requirements such as established cash flow and collateral.

Nevertheless, there are alternative financing options tailored to young businesses. 👶 Equipment financing is one of the beneficial options for startups that need physical assets to start their business, and the equipment itself secures the loan.

Microloans are also convenient and provide small amounts of capital, making them ideal for startups with minimal capital needs. 💸 These are available from various sources, including government programs, nonprofit organizations, and online lending platforms.

Business credit cards are another option that provides a revolving line of credit to address early-stage cash flow challenges. 💳

When evaluating loan applications, lenders consider factors such as your credit history, the ability to repay your loan from planned income and reserves, and the longevity of your business.

A personal guarantee from the business owner is often required, highlighting the need for a good personal credit history. 📊 Startups need to maintain loan payments to protect their business and financial health.

Equipment financing

Equipment loans are a great option for businesses that need to purchase equipment but don’t have the funds or revenue to do so. 🛠️ This type of loan allows businesses to borrow money to purchase needed equipment and then pay it back with interest.

This type of loan is usually secured by the equipment itself. 👉 This means that if the company defaults, the lender is entitled to seize the equipment as collateral.

However, some lenders still require a sales requirement. 💲 Therefore, you may need to prove that your business generates some form of income before considering an equipment loan.

Types of equipment that can be financed: 👇

-> Commercial Vehicles: This includes trucks, vans, and cars used for business purposes.

-> Audio/Visual Equipment: Media production items such as professional cameras, sound systems, and lighting equipment.

-> Restaurant Equipment: Commercial ovens, refrigerators, deep fryers, and other kitchen equipment fall into this category.

-> Construction Equipment: Items such as excavators, bulldozers, cranes, and loaders can be financed.

-> IT equipment: servers, data storage devices, network hardware, and other IT-related equipment.

-> Gym and Fitness Equipment: Treadmills, weight machines, stationary bikes, and other fitness equipment.

-> Manufacturing equipment: This can range from heavy machinery to small tools used in the production process.

-> Office Equipment: You can finance computers, printers, projectors, phones, and other essential office supplies.

-> Retail equipment: POS systems, display stands, security systems, and other retail-specific equipment.

-> Farm Equipment: You can finance tractors, combines, irrigation systems, and other farm equipment.

Microloans

For cash-strapped entrepreneurs to access microloans, several important steps are required. 👉 First, research microloan providers, such as nonprofit organizations, government agencies, and online lenders that specialize in small loans.

These institutions often focus on supporting startups and entrepreneurs who may not be able to obtain traditional bank financing. 💲 Next, create a solid business plan that clearly outlines your business idea, market research, and profitability plan.

This plan is important for convincing lenders of your potential for success. 🌟 Additionally, if possible, build a strong personal and business credit history to increase your credibility.

Finally, apply for a microloan by submitting your business plan and all necessary financial documents. 🔍 Many microloan providers also offer mentorship and business advice, making them valuable resources for start-up entrepreneurs.

Business credit cards

To get a business credit card when you’re self-employed, start by looking at cards designed for startups or individuals with limited business experience. 👉 Look for cards with low-interest rates, favorable terms and conditions that don’t require a high personal credit score.

When applying, use the company name and information to create a separate credit history for your company. 🧐 If necessary, use a personal guarantee or a credit card that leaves money as collateral.

Once approved, you can use your card for small, manageable purchases, pay your bills on time, and build business credit. 🧱 This responsible approach demonstrates your trustworthiness to lenders and gradually improves your creditworthiness for future financial projects.

Invoice financing

Invoice financing is another option for businesses without cash or revenue. 🙈 This type of loan allows businesses to use unpaid invoices as collateral to secure a loan from a lender.

The lender then advances an amount based on the invoice amount and once this is settled, the amount is repaid plus interest. This type of loan is ideal for businesses with stable cash flow but limited capital. 🚿

How to get funding for a business? Alternatives

Entrepreneurs seeking an alternative to traditional bank loans have several options: 🌟

- A popular method is crowdfunding. 👉 Crowdfunding involves presenting a business idea online and bringing together many people to make a small investment.

- Investment funds is another route suitable for high-growth startups and involves funding from investors in exchange for equity.

- Angel investors, usually wealthy individuals interested in early-stage investing, can also provide funding.

- Additionally, government grants and competitions are available that provide non-repayable funding for specific industries and initiatives.

- Peer-to-peer lending platforms and microloans are ideal for small financing needs and provide loans without traditional banking requirements.

Each option offers unique benefits and suitability depending on your business model and stage. 👇

Business grants and competitions

Grants and competitions provide startups with additional opportunities to secure funding without the need for repayment or retention of capital. 👉 Grants are typically awarded for a specific purpose and may come from various institutions. These are especially useful for startups that have progressed beyond the concept stage.

Contests offer entrepreneurs the opportunity to pitch their business ideas in exchange for prizes or services. 🗣️ These events also provide information disclosure, networking opportunities, and expert feedback.

Although these events are competitive in nature, winning grants and winning competitions can provide startups with significant financial support without the obligations associated with financing itself. 😏

Partnership with other companies

Partnering with an established company opens up additional funding opportunities and gives your startup credibility. Beyond financial support, these partnerships provide access to a broader network and resources. 🌎

It’s important to carefully evaluate each partnership to ensure alignment with your business objectives and fully understand the financial implications. 🤓

Crowdfunding

Crowdfunding has become a popular and accessible way for startups to raise money without the restrictions associated with traditional financing. 🤩 The model involves collecting small donations from a wide audience, primarily through online platforms.

This is especially suitable for startups offering unique services and allows them to connect with potential backers around the world. 🌎

There are various crowdfunding models: equity, reward-based, donation-based, and debt-based:

- Equity crowdfunding involves exchanging company shares for funds, while reward-based crowdfunding provides investors with a certain amount of compensation.

- In reward-based crowdfunding, individuals donate to a project or business with the expectation of receiving non-monetary consideration, such as goods or services, at a later date.

- Donation-based crowdfunding is typically reserved for social or non-profit ventures, while debt-based crowdfunding works similarly to traditional loans, requiring repayment over a period of time and, in some cases, requires interest.

- Debt-based crowdfunding, also known as “peer-to-peer lending” or “P2P lending,” is similar to traditional lending. Instead of getting a loan from a bank, you get a loan from a group of investors. The startup agrees to repay the loan with interest over a set period of time.

Platforms like Kickstarter and Ulule are known for their crowdfunding efforts. 🙌 Yet success requires a compelling campaign, clear goals, attractive rewards, and consistent communication to keep supporters engaged.

Successful campaigns often raise large sums of money, and crowdfunding can also gauge public interest in a business concept. 📣

Investment Funds

Accessing investment funds without equity capital as an entrepreneur requires a strategic approach. 🎯 Start by thoroughly researching and identifying potential investors who have previously funded startups in your industry.

We prepare a compelling proposal and detailed business plan that clearly demonstrates your idea’s potential, including market research, revenue projections, and a clear path to profitability. 💱

Build an extensive network to connect with venture capitalists, and investment groups. 🤓 Attend startup events, pitch contests, and industry conferences.

Use online platforms that connect startups and investors. 👉 When working with potential investors, we focus on building relationships and effectively communicating the vision and long-term value of the company.

Business Angels

“Angel Investors” or “Business Angels” are individuals with the means to invest in startups, often providing capital in exchange for stock.

They can also provide valuable mentorship and industry connections. 👉 Networking through platforms like AngelList, Angel Capital Association, and Angel Investment Network or even LinkedIn, makes it easy to meet potential investors. There are specialized groups in various industries that offer targeted opportunities for startups.

When looking for an angel investor, it’s helpful to reach out to someone who has expertise in the field and a track record of successful investing. 💰 The approach must effectively communicate the company’s potential and align with investors’ interests.

Recap: How to get a business loan for a new business ?

Building a startup is like going to the gym. 💪 The first time is always the most difficult. Securing a startup business loan without capital can be difficult, but not impossible. This requires a strong understanding of the company’s financial projections, as well as a high level of organization and tenacity.

Start by creating a solid business plan that shows how profitable your business is. 🤑 Look for assets that can be used as collateral. Create realistic financial projections that guide your repayment strategy. And most importantly, prepare for the potential risks and challenges that lie ahead.

Be transparent with your lender during this process. 🧊 Clearly explain your business model, goals, and strategy. Highlight your plans to generate revenue and what measures you are taking to reduce risk.

Keep in mind that lenders are more likely to invest in your idea if they understand it and see its potential. 💡

FAQ : How to Get a Startup Business Loan With No Money?

Is it possible to get a business loan with no money ?

Yes, it’s difficult, but it’s possible to get a business loan even if you don’t have the money. 😊 Options include microloans, crowdfunding, and finding investors such as angel investors and venture capitalists.

Creating a strong business plan and demonstrating the potential for success can go a long way in securing such funding. 👏

How to get a business loan if you just started? How can I fund a startup with no money?

To access business loans when you’re just starting out, focus on government-backed loans, etc. 👉 Building good personal credit and leveraging networks of angel investors and venture capitalists can also be beneficial.

Now you know how to get a startup business loan with no money! 🤑