In this article , we will look at the definition of Profit Margins and the calculation of the margin and percentage.⚡ Also, examples of how to use it so that you can be more profitable when prospecting in B2B.

Calculate Gross Profit Margins

The profit margin or sales margin can be calculated for a single product or for total sales.

For example , if a merchant buys a product at $15 and sells it at $25 , the profit margin is $10 .

👉 S ale price before tax ($ 25) – Purchase cost before tax ($15) = Profit margin ($10).

For example, if the merchant’s sales before tax are $ 30 ,000 and the total purchase cost of goods sold is $ 10 ,000, the profit margin is $ 20 ,000 .

👉 Sales excluding VAT ($30,000) – Purchase cost of sales excluding VAT ($ 10 ,000 ) = Profit margin ($ 20 ,000 ).

All examples used do not include “value added tax”, i.e. the VAT is simply a tax that the merchant collects and then pays, so it is not taxable (at least in France).

Profit Margins: Economic Definition

The sales margin or gross margin is an essential indicator for the company. 🤓 The profit margin calculates the difference between the selling price and the cost of a product or service. It is an important performance indicator of profitability. A business is profitable if the margin covers business expenses , especially rent and wages, and generates a surplus. 💲

👉 In contrast, a company will suffer a loss if its commercial margin (profit margin) is not sufficient to cover its fixed expenses and operating expenses. The calculation of the profit margins allows you to analyze the business model of your company and apply the appropriate measures to improve your profitability.

The Profit Margin Formula

Calculating the profit margin as a percentage

There are several ways to calculate the percentage of the profit margin. 💹

💡 We will see 2 ways to calculate it together, below:

A margin percentage can be calculated in relation to a partial amount , such as the purchase price of a product before tax. This is called the “outside” percentage calculation, which is used for the calculation of the profit margins percentage.

For example, a merchant buys a product for $ 100 before taxes, and he wants to have a profit margin of $50 before taxes. 🤑 So, he calculates the profit margin percentage from the purchase price excluding VAT, and he gets a percentage of 50%.

👉 (Margin before taxes $50 / Purchase price before taxes $100) x 100 = 50% of the purchase price before taxes.

The calculation of the percentage “inside” is the calculation of the margin percentage from the sales price excluding VAT. This inside markup is also called the mark-up percentage. 💥

For example, a merchant sells a product at $ 100 excl. tax and his profit margin is $50 excl. tax too. 🤑 So, he calculates the mark-up from the sales price excluding VAT (called mark up percentage) and he gets a percentage of 50%.

👉 (Margin before taxes $ 50 / Sales price before taxes $ 100 ) x 100 = 50% of the sales price before taxes .

Sales margin in Statement Balances

The Statement Balances allow you to identify and analyze the factors that will contribute to shape your results . They allow you to distinguish between factors related to production ( regular business activities ), those related to investment and financing ( debt load ) and those of an exceptional nature . 📋

In accounting, the statement balances are presented in a table that calculates the following indicators step by step (including the calculation of the profit margin) : 👇

- The profit margin,

- The gross surplus,

- The added value,

- The operating result,

- The financial result,

- The result before tax,

- The EBITDA,

- The result for the year.

👉 To get more info about the statement balances and the EBITDA, then read this article!

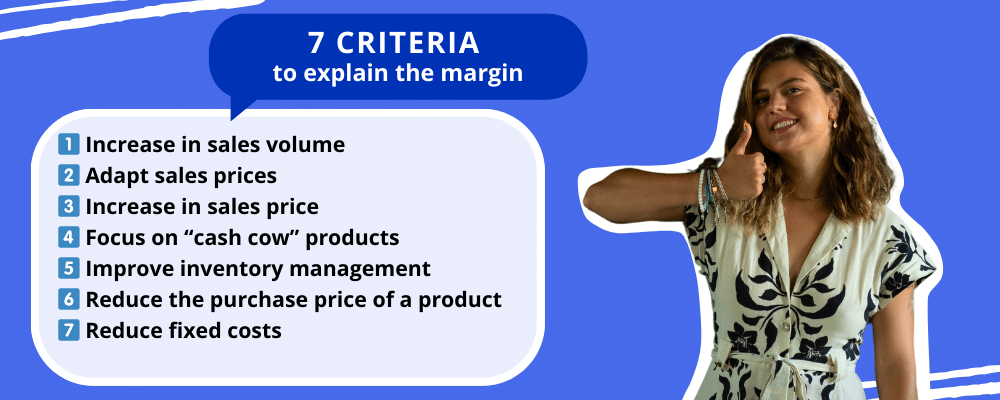

7 Criteria used to explain the margin

Criteria like sales price , sales volume , purchase cost , inventory fluctuation : 🧮 each element of the formula represents a factor that affects the profit margin.

Let’s take a look at these criteria to explain the profit margin, in more detail. ⏬

1) Increase in the volume of sales:

By increasing the volume of sales, the company increases its profit margin too . 😉

There are several ways to increase your sales volume :

- Lower the selling price . Note that lowering the selling price also reduces the margin. It is therefore important to find the right balance . Lowering the price so that the increase in sales volume is sufficient to increase the profit margin .

- Invest in a communication plan and sales force plan. Be careful, these investments may reduce your margin . Therefore, it is important to proceed in a balanced way so that your investments have a positive effect on your bottom line . Don’t forget that effective communication helps to establish you as an expert in your target market. This way , your company can increase its prices without fear of losing customers .

2) Adapting the sales prices:

Adjusting the sales prices according to the supply and demand. 🎯

Practicing price adjustments improves the sales margins (profit) :

- Strong demand = Increased profit margins thanks to higher selling prices.

- Low demand = Higher sales volume , resulting in higher sales margins .

3) Increase of the selling price:

At first glance , this technique appears to be the most obvious and easiest to implement . However, you must not reduce the volume of sales. Otherwise, the technique will be useless. 🙈 To increase the prices without losing sales, it is important to regularly compare your company ‘s prices with those of your competitors .

A well-communicated improvement in the company’ s offering can help explain the price increase . The company is so confident of the loyalty of its customers that it can also raise prices with less risk. 🙏

4) Focus on the “cash cow” products:

The ” cash cow ” products, in the BCG matrix, are the products that contribute the most to the net profit of the company. 🐄 By calculating the mark-up percentage , the company can identify the most profitable products . The company can then focus on “profitable” products to increase profits.

5) Improve the management of stock:

Varying inventory is a component of the sales margin formula . ✍️ A better management of stock increases profit margins .

There are two main objectives :

- Avoid to stock excess inventory, which is costly and without value.

- Avoid the shortages of stock, which lead to the loss of opportunities .

The company ensures to work in just-in-time to improve its profit margins . The supply is proportional to the demand and the cost of production is optimized. 💯

6) Reduce the purchase price of a product:

Lowering your purchase price will increase your sales margin as well. It’s tricky because suppliers also have margins that shrink accordingly . 😬

However, you have two options :

- Increase the purchase volume.

- Turn to other suppliers .

7) Reduce the fixed costs :

Fixed costs are excluded from the formula for calculating the profit margin , fixed costs are taken into account in the calculation of the EBITDA . 💥 However , all these criteria have a common goal . That of increasing the profitability of your business by increasing your sales margins.

Therefore , the company increases its margins by reducing its fixed costs , salaries and rent. 🤨 To achieve strategic savings , it is important to evaluate each item of expense separately and readjust based on sales.

👉 In summary, increasing your profit margins requires a lot of time and optimization of the internal process . Above all , it is important that you pay special attention to maintaining the quality of your products and services at all times, keeping regular analysis of each factor that can improve or degrade your margins, and make the appropriate decisions for your business .

2 Examples of the profit margin

How to calculate the selling price based on the Profit Margins?

A company can use profit margins to calculate selling prices for products or services. It represents the added value that a business brings to its product or service for a cost. 💰 Companies must therefore master it to ensure and improve the profitability of their activities, margins are, therefore, a valuable indicator for the calculation of sales prices . 🤩

This added value allows you to:

- Define the commercial offers, such as promotions or discounts .

- A nalyze the competition and the field of activity of your company.

From the profit margin, the selling price is calculated as follows :

For example, a company produces goods at a cost of $ 150 . The company wants a profit margin of $ 50 on each sale of the product . The selling price is then set at $ 200 .

👉 Regarding the definition of the selling price , there is no ideal sales margin . 🧐 Indeed, margins can vary greatly depending on the sector of activity. A good commercial margin consists of a margin defined to sell a product or service at a reasonable price , thus ensuring the sustainability of the activity.

There are several ways to improve the profit margin in terms of price and cost:

- Increase the selling price of a product.

- Increase the sales volume.

- Reduce the volume of product purchases.

- Reduce the average price of supplier purchases.

1) Example of the “outside” margin percentage calculation = Profit Margins Percentage

The profit margins percentage is the percentage of the purchase price of products and services before tax. This is very useful when dealing with negotiation of prices with suppliers. 😏

It is calculated as follows : 👇

For example, a merchant sells a product for $ 50. If its purchase price is $ 25, its sales margin is $ 25, so the margin percentage is 100% .

- (Profit margin $ 25 / Purchase price before taxes $ 25) x 100 = 100% of profit margin percentage.

However, if the merchant negotiates the purchase price at $ 10, the margin increases to $ 40, or 400% profit margin percentage. 👀

- (Profit margin $40 / P urchase price before taxes $ 10 ) x 100 = 400 % of profit margin percentage.

2) Example of the “inside” markup calculation = Mark up Percentage

Unlike the profit margin percentage, the mark up percentage is used to determine the percentage of margin included in the sales price excluding VAT.

It is calculated as follows : 👇

For example, if a merchant buys a product at $ 10 excluding VAT and resells it at $ 50 excluding VAT, then his markup is 80% .

- [( Sales price before taxes $ 50 – Purchase price before taxes $10 ) / Sales price before taxes $50 ] x 100 = Mark up percentage of 80%.

Comparing your mark up percentage with that of your direct competitors allows you to establish your market position in your industry, 🪙 and to define your selling price .

Conclusion: How To Calculate/Find Profit Margins?

To conclude, the calculation of the profit margin is based on the difference between the sales ( sales price x quantity sold) and the acquisition cost of the goods consumed (purchase price + acquisition surcharge + inventory change ). 🙂 To eliminate the notion of VAT, it should always be calculated before taxes.

The gross margin is an important measure for determining the selling price of a company ‘s products or services . On the contrary , by taking into account possible purchase costs and inventory fluctuations , the company will avoid selling at a loss, since it is considered unfair and prohibited. 😥

In addition , the business will certainly bear the cost. In other words, the business will not be able to survive … Note that the concept of a good business margin varies in different industries . 🔍 Therefore , it is important for every business to evaluate its own profit margins compared to its competitors.

Now, that you know the calculation of the profit margin, let’s review some key concepts! ✨

Net Profit Margin

Net profit margin or net profit is different from profit margin . 🔔 It shows the profit per dollar of sales after deducting operating costs, interest and taxes .

For example , if your net profit margin is 50% , it means that 1 euro of sales will result in a net profit of 50 cents. 💸 A high net profit margin is a sign that the business is doing well. This criterion could also explain why some companies are likely to be more profitable than their competitors .

👉 The calculation of the net profit margin allows for a better analysis of the gross profit margin. For example, a merchant buys products for $50 ,000 and resells them for $100 ,000 , his gross margin is $50 ,000 . His business makes a profit of $10 ,000 and has a total sales of $100 ,000 . Therefore, his net profit margin percentage is (10, 000/100, 000) x 100 = 10% .

A business can have good sales margins , but have low net profit margins , so both criteria must be calculated and analyzed . ⚡

Profit Margin Percentage Vs. Mark up Percentage

Profit margin percentage is also an important indicator that should not be ignored in the economic analysis of the company. In fact , companies can evaluate their ability to generate profits, pass on cost increases to their customers or negotiate purchase prices with their suppliers. ♟️

The profit margin percentage can be calculated as follows:

For example, if an item sells for $150 before taxes and its purchase price is $ 100 before taxes, then the sales margin is $50 before taxes and the profit margin percentage is : (50/100 ) x 100 = 50%. So, if the profit margin percentage is 50% , it means that the company has a sales margin of $50 before taxes to cover its fixed costs. 🏹

The profit margin percentage is an indicator of the power of negotiation of a company. The higher the profit margin percentage , the better the negotiation with the supplier. 😏 Companies with specific know-how can easily differentiate themselves from their competitors, and achieve higher profit margin percentages by selling at higher prices .

👉 On the other hand, the mark up percentage compares the profit margin to the selling price . Using the previous example , the mark up percentage is equal to (50/150 ) x 100 = 33%.

The products with the highest mark up percentage are the most interesting to exploit in order to increase the profitability of the company. 🚀

FAQ of the article

What is the difference between Profit Margins and Gross Margin?

The gross margin is calculated from the purchase price of the goods or services, plus the costs of acquiring and setting up the purchased goods/services . 🛒 Whereas, the profit margin is calculated from the purchase cost of goods or services. 🤓

What is the highest profit margin industry in the US?

In 2022, the profit margin for Trusts and Estates business in the US is: 54.6%, this includes trusts, estates, and accounts that are managed on behalf of beneficiaries under the terms of a fiduciary contract. 📋 Revenue in the industry increased little over the five years to 2022, owing mostly to capital gains on trusted assets and regular dividends. Over the next five years, sales are expected to grow at an annualized pace of 0.7% to $197.9 billion. 💥

There you go, now you know all about Profit Margins in order to boost your sales! 🚀