- What are customer acquisition cost?

- Why do you need to know your customer acquisition cost?

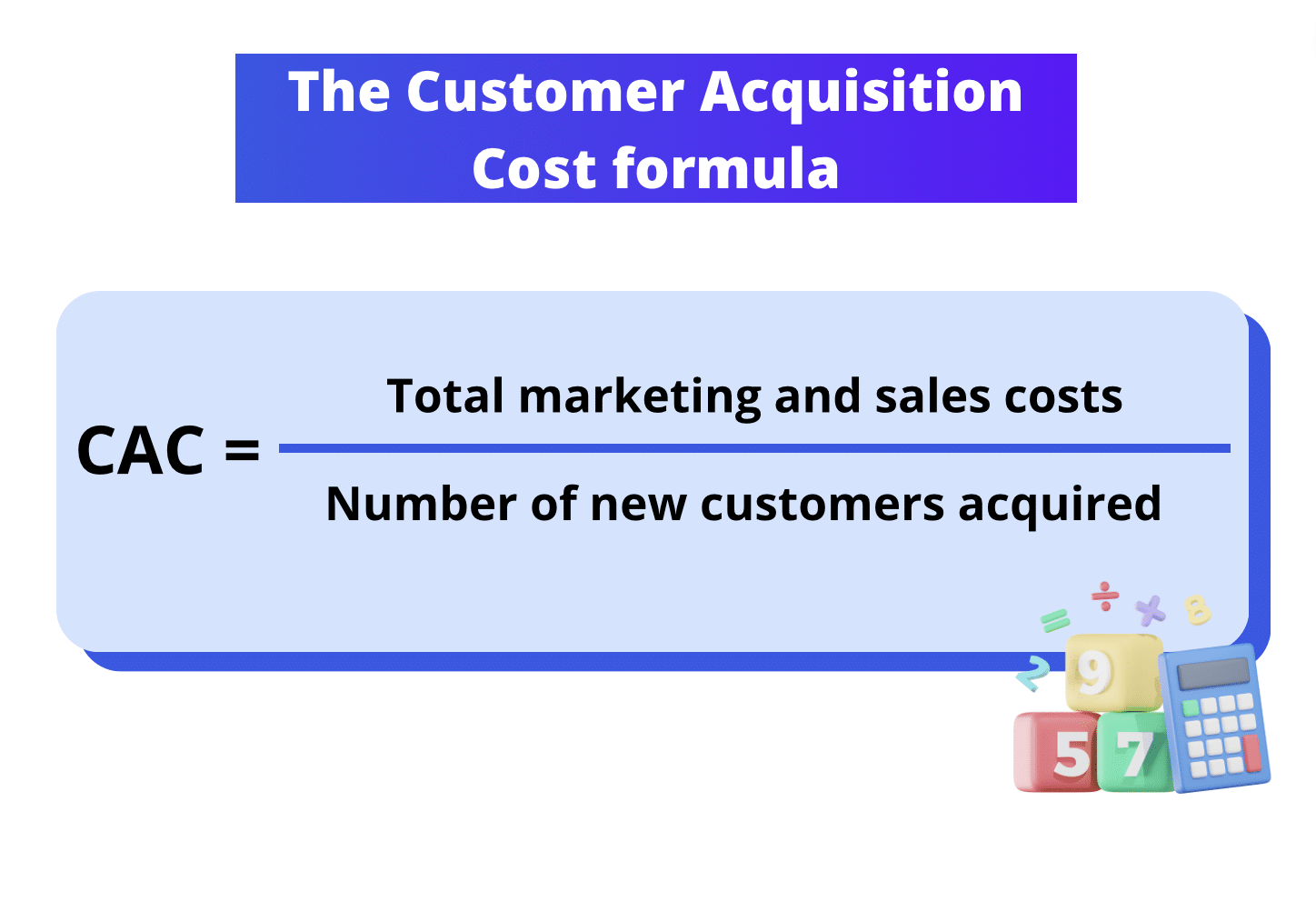

- How to calculate CAC?

- Case study : How is customer acquisition cost applied?

- How do you analyse your customer acquisition costs?

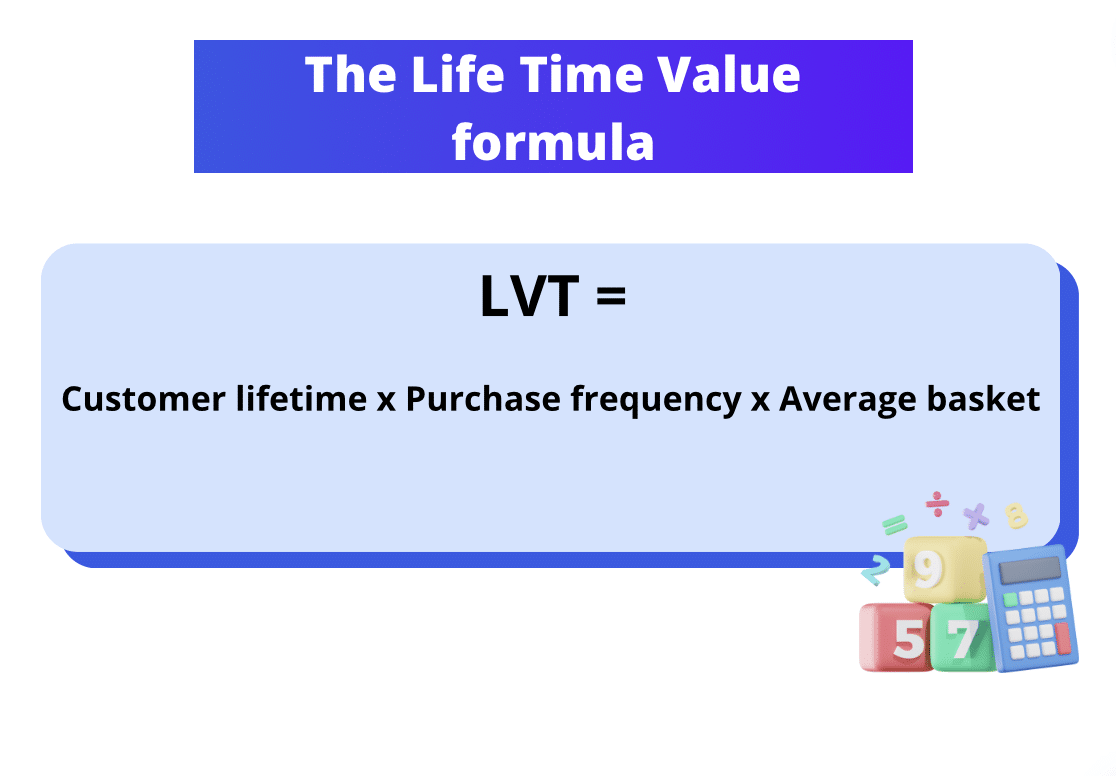

- The link between customer acquisition cost and life time value (LTV)

- Frequently asked questions

Want to understand how to control your customer acquisition cost (CAC) in just 5 minutes? You’ve come to the right place! We know that in the world of business, every euro counts, and that knowing your CAC is the key to optimizing your marketing spend and boosting your ROI. 💰

Today, I’m giving you all the tips you need to calculate, understand and, above all, reduce your customer acquisition cost. Get ready to transform your marketing approach and skyrocket your profits 🚀

What are customer acquisition cost?

Customer acquisition cost (CAC) is the total amount you spend to convert a prospect into a customer. It includes all marketing and sales costs. Basically, it’s how much you put on the table for a prospect to become a customer. 💸

Why do you need to know your customer acquisition cost?

Knowing your CAC is essential for several reasons:

- 💰 Profitability: If your CAC is higher than your customers’ lifetime value (LTV), you’re losing money. To be profitable, it’s crucial that the CAC be lower than the LTV. If you spend more to acquire a customer than they bring in, you lose money with each new acquisition, which can quickly affect your cash flow and growth.

- 💸 Budgeting: Allocate your resources intelligently to maximize your return on investment (ROI). Knowing this allows you to allocate its budget optimally. You can invest more in the best-performing channels and reduce spending on those that are less effective. This allows you to plan your expenditure more precisely.

- 🧠 Strategy: Identify the most effective acquisition channels and adjust your strategy accordingly. By analysing this by channel, you can see which are the most profitable. For example, if email campaigns have a lower CAC than paid advertising, you can boost your efforts in email marketing to optimize your results.

How to calculate CAC?

The formula

⭐️ The formula for calculating your CAC is simple:

➡️ For example:

- Total marketing and sales costs: $3,000

- Number of new customers acquired: 10.

CAC= $3000/ 10 = $300

You can categorize the cost of customer acquisition according to the areas of expenditure (SEO, ADS…) and track the number of customers acquired per channel in order to compare them and see which are the most profitable!

Case study : How is customer acquisition cost applied?

I’ve prepared a few examples to help you understand the formula 100%!

Situation 1: The CAC of free or freemium trials 🎁

➡️ To calculate it via free trials or freemium :

- Development and maintenance costs:

- Include development costs for the freemium version of your product, as well as maintenance expenses (servers, customer support, updates, etc.).

- Example: $5,000.

- Marketing costs :

- Add expenses for advertising, promotions and campaigns designed to attract users to the free trial.

- Example: $2,000.

- Conversion:

- Track the number of users switching from the free version to the paid version.

- Example: 1,000 users upgrade to the paid version.

➡️ This gives us, for example :

- Development and maintenance costs: $50,000.

- Marketing costs : $20,000.

- Conversions: 250 users upgrade to the paid version.

⭐️ CAC: ($5000 + $2000) / 150 = $47 per customer

Situation 2: Search engine optimization (SEO) 🌐

➡️ To calculate the cost of customer acquisition for SEO :

- Content creation and optimization costs:

- Include costs for copywriting, SEO strategy optimization, tools and the price of the blog.

- Example: $15,000.

- Costs of backlinks and partnerships:

- Add the expenses for obtaining quality backlinks and establishing partnerships.

- Example: $5,000.

- Conversion:

- Track the number of new customers acquired through organic traffic (via CTAs, for example).

- Example: 200 new customers.

➡️ This could give us, for example:

- Creation and optimization costs: $15,000.

- Cost of backlinks and partnerships: $5,000.

- Conversions: 200 new customers.

⭐️ CAC: ($15,000 + $5,000) / 200 = $100 per customer.

Situation 3: Targeted advertising on LinkedIn

➡️ To calculate it via targeted advertising on LinkedIn:

- Advertising content creation costs:

- Include the costs of creating visuals and advertising copy, as well as the costs of producing videos or other content used in ads.

- Example: $5,000.

- Advertising costs:

- Add up the expenses for running ads on LinkedIn, including cost-per-click (CPC) or cost-per-thousand impressions (CPM).

- Example: $15,000.

- Campaign management costs:

- If an agency manages your campaign.

- Example: $3,000.

- Conversion:

- Track the number of new customers acquired thanks to the LinkedIn Ads campaign.

- Example: 300 new customers.

➡️ This could give us, for example:

- Cost of creating advertising content: $5,000.

- Advertising costs : $15,000.

- Campaign management costs: $3,000.

- Conversions: 300 new customers.

⭐️ CAC: ($5,000 + $15,000 + $3,000) / 300 = $76.67 per customer.

How do you analyse your customer acquisition costs?

You’ve calculated your acquisition costs, now what do you do with them?

➡️ Analysing your CAC involves :

- Track costs regularly: Keep track of all marketing and sales costs to get an accurate picture of your expenses, with a dashboard, for example.

- Segment by channel: Identify how much each channel costs you to acquire a customer, and which ones perform best. For example, if Google Ads has a CAC of $170 and SEO has a CAC of $133.33, it might be more cost-effective to concentrate your efforts on SEO.

- Compare with LTV: Make sure it is well below LTV to guarantee profitability.

- Continuous optimization: Adjust your strategies and test new approaches to reduce your CAC and improve ROI. For example, use A/B testing to optimize your advertising campaigns and experiment with different content and offers to see what works best.

By knowing and analysing the latter, you can make informed decisions to optimize your marketing spend, maximize ROI, and grow your business sustainably. 🚀

The link between customer acquisition cost and life time value (LTV)

Lifetime value (LTV) represents the net income a customer generates for your company over the entire duration of their relationship with you. To guarantee profitability, your LTV must be higher than the CAC. A good LTV/CAC ratio is at least 3:1, which means that every euro spent on acquisition should yield three euros in customer value. You can’t have one without the other.

➡️ This is how LTV is calculated:

➡️ For example:

- Customer lifetime: 3 months on average

- Purchase frequency: 2 orders per month

- Average basket: $200

Your LTV = 3 x 2 x 200 = $1,200

➡️ If we relate this to the CAC we obtain :

LVT / CAC = 1,200 / 300 = 4

In this case, the 1:3 ratio is well respected. For every $1 spent, $4 is raised. This means that the company is profitable. 💰

That’s the end of this article. I hope I’ve answered all your questions about customer acquisition cost! 🚀

Here’s a quick summary of what we saw together:

- Defining the cost of customer acquisition.

- CAC calculation.

- Case studies of its application.

- The link between CAC and LVT.

Frequently asked questions

What are the levers for reducing customer acquisition costs?

Optimize customer targeting 🎯:

- Precise segmentation: Use segmentation tools to identify the most profitable market segments. For example, you can use Google Analytics and demographic data to focus your efforts on those customers most likely to convert. This maximizes the effectiveness of your marketing campaigns and reduces costs.

Improve lead quality 🌟:

- Content marketing: Develop quality lead generation strategies, such as creating inbound marketing content (blogs, videos, e-books).

- Using SEO: Optimize your website via the three pillars: Technical, Trust and Content. Attracting quality visitors will reduce your need to spend on advertising.

Tips: Offer downloadable content in exchange for visitors’ contact information, which will enable you to enrich your CRM and contact them again later! 👀

Optimize advertising campaigns 📈:

- A/B testing: Run A/B tests on your ads to determine which ones perform best. Use platforms like Google Ads… to precisely target your audience. Test different images, headlines and calls to action to see which work best.

Automate marketing processes 🤖:

- Automation tools: Don’t hesitate to use marketing automation tools like Waalaxy to manage and optimize your email campaigns, for example. These tools enable you to create automated workflows, improving campaign efficiency and reducing CAC.

Improve the customer journey and user experience 💡:

- Website optimization: Analyse visitor behaviour and identify friction points on your website. Improve the user experience, by simplifying the purchasing process, or the number of steps required to complete a transaction. Having a clear shopping tunnel will increase your conversions!

- Personalize the experience: Offer your customers a personalized experience, using data to tailor content and offers to each user’s preferences and behaviour. For example, create a landing page for each of your segments.

Now you know all about customer acquisition cost! 🥳