You are a self-employed entrepreneur but you don’t know everything about the legality 👩⚖️. Today we focus on the ceiling in auto entrepreneur.

You certainly ask yourself many questions about the different ceilings in auto-entrepreneur (or microentrepreneur). We’re going to talk about turnover amount, VAT and declaration 📜.

What we are going to discover during this article revolves around the following topics:

- The ceiling in auto-entrepreneur.

- The turnover ceiling.

- The ceiling on VAT.

- Information on the declaration of your income.

- The thresholds.

Auto entrepreneur : ceiling

In order to push more and more people to create 🔧 their micro-enterprises, the legal status of microentrepreneur is easy since everything is simplified. We’re talking about simplified steps in terms of your tax, accounting and social system. We will talk about the different ceilings in this section: that of the turnover but also of the VAT.

Ceiling of the auto entrepreneur turnover

When you are a self-employed entrepreneur, you are subject to an annual turnover ceiling for activities under the microentrepreneur scheme. This ceiling varies according to the activities carried out. To make this more easily observable 👀, here is the table of CA not to exceed, depending on your activity. These ceilings are to be considered without VAT.

| Sector of activity | Ceiling of CA |

| Purchase/sale of goods (BIC) | 188 700€ |

| Sale of foodstuffs for consumption on the premises | 188 700€ |

| Lodging services | 188 700€ |

| 77 700€ | |

| Liberal activities | 77 700€ |

Self-employed VAT ceiling

If you were not aware, you should know that as a microentrepreneur, you do not have to charge 💰 VAT… At least up to a certain threshold of your turnover. You will not have to charge VAT in the following cases:

- 85 800€ of turnover in the case of sale of goods.

- 34 400€ in the case of services.

| Sector of activity | VAT ceiling |

| Purchase and sale of goods (BIC) | 85 800,00 € |

| Sale of foodstuffs for consumption on the premises | 85 800,00 € |

| Accommodation services | 34 400,00 € |

| Commercial or artisanal services | 34 400,00 € |

| Liberal activities | 34 400,00 € |

Understand that your maximum turnover does not change of course, it is simply the addition of VAT in this case. We repeat so that you can understand better:

- In the case where you are in the commercial sector of purchase/resale of goods, you can make up to 188,700€. If you make €30,000 of turnover out of these €188,700, you remain in the micro-entrepreneur category and you do not add VAT. If you make 105 500€ of turnover, in this case, you will have to invoice the VAT but you will remain under the status of auto entrepreneur.

The declaration of income as an auto entrepreneur

It is extremely important that you make your income declaration even when you have 0€ of income 😮. You need to go to the URSSAF website and start declaring your income. The whole procedure is simple, you will just have to follow the instructions that you are asked to complete.

If you are late with your declarations, you risk penalties. You will be informed by the URSSAF of your failures.

Thresholds in auto entrepreneur

As we said before this article, in order to benefit from the advantages of the micro-enterprise status, you must make sure that you do not exceed certain thresholds, especially in terms of turnover.

Turnover thresholds

You will have to remember only two of them concerning the turnover:

- 188 700 € for all that concerns the purchase/resale of goods, the sale of foodstuffs to be consumed on the spot as well as accommodation services.

- 77 700 € for commercial or artisanal services as well as liberal activities.

VAT thresholds for auto entrepreneurs

For the VAT, it is from these amounts that you will have to apply it:

- 85,800.00 € concerning the purchase/resale of goods, the sale of foodstuffs to be consumed 🍎 on the spot as well as accommodation services.

- 34 400,00 € for what concerns for the commercial or artisanal services as well as the liberal activities.

Conclusion of the article

It is true that it is difficult to find one’s way among the flow of information that can be found on the internet concerning the ceilings in auto entrepreneur. In order not to lose you, we are going to summarize in a table the ceilings not to be exceeded regarding the turnover and the VAT.

| Sector of activity | VAT ceiling | Turnover ceiling |

| Purchase/sale of goods (BIC) | 85 800,00 € | 188 700€ |

| 85 800,00 € | 188 700€ | |

| Accommodation services | 85 800, 00 € | 188 700€ |

| Commercial or artisanal services | 34 400,00 € | 77 700€ |

| Liberal activities | 34 400,00 € | 77 700€ |

FAQ

We’re almost to the end of this article, and there are still a few things we can teach you. Come on, follow us 👇.

What happens if the limits are exceeded?

In case you exceed the various thresholds, don’t worry, you won’t have to suffer any penalties like forgetting to file. In order for there to be any change, you must already have exceeded the threshold two years in a row. If for the second year in a row, your business earns more than the legal limits, then you will no longer belong to the micro-entrepreneur regime.

You will, in fact, be placed in the sole proprietorship category for the following year. So you will have understood 😁 as soon as you exceed the turnover for two years in a row, we will directly change your status. This will imply adjustments at the fiscal and social, accounting and administrative level.

Great, but in this case, what happens concretely? Well, to be honest with you, it will greatly depend on the nature of your activity as well as the profits you make (🔺warning, profits are very different from turnover).

You will thus be at new obligations such as:

- Take an annual inventory.

- Setting up annual bookkeeping with a balance sheet.

- More important contributions.

- And so on…

In any case, if you exceed the turnover imposed in micro-entrepreneurship, the best thing to do is to find out about the different statutes and choose the one that suits you best.

Differences between profits and turnover

In order to clear up any doubts about these two terms, let’s define together what turnover is.

To make it simple, the turnover (or CA), is what will correspond to all the money inflow 💰 related to your activity. This can be:

- Selling merchandise.

- Sale of handmade products.

- Services rendered.

When you start your business, you’re going to have to pay payroll taxes (that’s the less fun part). If you subtract your charges from your sales, that’s called profit. Now you know the difference between the two.

How and when do I declare my turnover as a self-employed entrepreneur?

There are two ways to declare your income when you are a micro entrepreneur:

- Monthly.

- Quarterly.

First declaration

You have started and got your first client and therefore you will have to do your first tax return. Don’t worry, everything will be fine. When you start a business, in the case of a monthly payment, you must file your return before the end of the month following your first three months in business.

If you have opted for quarterly declarations, you simply have to make your declaration before the end of the month following the quarter in which you started your activity.

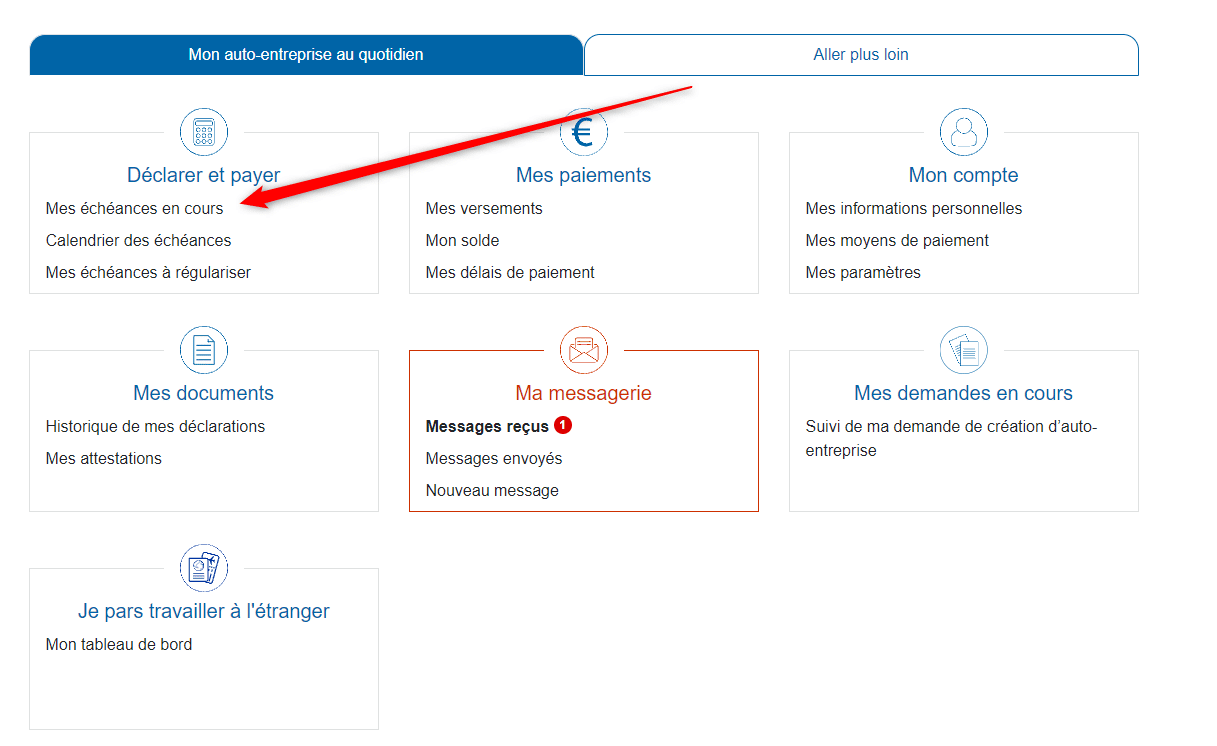

Now, how do you declare your activity? We can assure you that it is very simple. Go to theURSSAF website:

- Log in with your login and password.

- Go to the “Declare and pay” section.

- Click on the month for which you had income.

- Fill in what you are asked to do.

- The calculation is done automatically for both the contributions and the payment of income tax ( if you have selected it).

- All you have to do is choose your payment method 💸.

And it’s as simple as that, no need to do more.

Delay or absence of declaration auto entrepreneur

Obviously the procedure is facilitated for auto entrepreneurs. However, be careful to stay up to date with your declarations because an oversight could cost you dearly.

Indeed, if you did not declare your income within the time limit, a penalty of 55€ is applied to each missing declaration. And of course, you also risk a surcharge on your social security contributions.

If you have missed a turnover declaration, you will be notified by registered letter of the social contributions to be paid for your missing declarations. As such, even when you have no income, you must declare the amount of 0€.

Good to know

Once your company is created, you are automatically eligible for the microenterprise regime for the first two years.

If you exceed the turnover thresholds of the microenterprise regime for two consecutive years, you will switch to a simplified real taxation regime. This change of regime will take place on January 1st of the year following the second year in which the threshold is exceeded. If you exceed the microenterprise threshold for only one year, you are still eligible for the microenterprise regime.

You now know everything there is to know about the auto entrepreneur ceiling.